- What is a Payment Gateway and Why is it Important for Your Ecommerce Business?

- Top 10 Payment Gateways for Ecommerce in the USA

- Top Security Tips When Choosing Payment Gateways for Ecommerce

- Tips for Optimizing User Experience (UX) for a Frictionless Checkout

- Additional Tips for a Successful Online Payment Gateway Integration

- Conclusion

- Frequently Asked Questions (FAQs)

Table of Contents

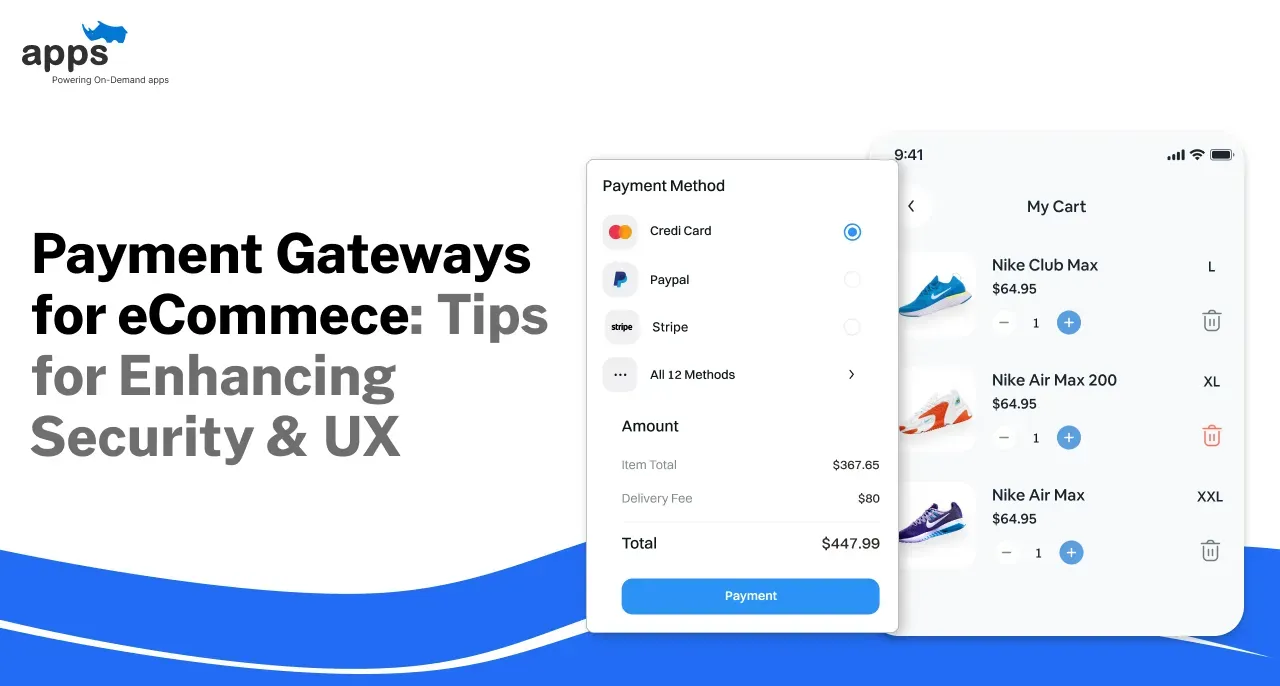

Payment Gateways for eCommece: Tips for Enhancing Security & UX

Many people have already shifted to the ecommerce market, and many more are in the process. But with such a wide audience comes the challenge of handling numerous transactions daily. Moreover, factors like security and privacy are vulnerable to breaching.

Over the years, payment gateways for ecommerce have become unsung heroes. They handle the delicate task of processing payments, and ensuring smooth transactions between buyers and sellers.

But here's the shocking truth: these gateways are less secure than you might think. Yes, even the big players in the industry have experienced vulnerabilities and have worked to fix them to provide better security.

So, how do we balance enhancing security and providing a user-friendly experience?

Let’s explore some tips for navigating the world of payment gateways while keeping security and user experience at the forefront.

What is a Payment Gateway and Why is it Important for Your Ecommerce Business?

A payment gateway is a technology that securely facilitates online transactions between customers, merchants, and banks. It acts as a secure bridge, transmitting customer payment information, such as debit or credit card details, to the bank for authorization.

Once approved, the payment gateway processes the transaction, transferring funds to the merchant's account.

This technology is vital for e-commerce businesses as it ensures smooth, secure transactions, builds trust with customers, and supports global commerce by enabling international payment gateways. Some of the top payment gateways for e-commerce include PayPal, Stripe, and Square.

Benefits for Businesses and Customers

With online payment gateways for ecommerce, businesses can enjoy secure and efficient payment processing, reduced risk of fraud, and expanded accessibility to a wide range of payment methods.

- Businesses enjoy secure, efficient payment processing, protecting customer data, and smooth transactions.

- Reduced risk of fraud through advanced encryption and secure channels ensures safer ecommerce operations.

- Access to multiple online payment gateways expands business reach and accommodates diverse customer preferences globally.

- Customers experience secure transactions, fostering trust and confidence in the ecommerce platform’s reliability.

- Seamless checkout experiences reduce cart abandonment and improve overall customer satisfaction.

- Diverse payment options, including international methods, ensure a convenient and inclusive shopping experience.

- Enhanced security and UX provided by online payment gateways increase customer retention and loyalty.

Top 10 Payment Gateways for Ecommerce in the USA

International payment gateways are essential for any e-commerce business, enabling secure and efficient transactions for a wider audience. Here are the top 10 payment gateways to consider for your e-commerce store:

1. PayPal: Trusted globally, PayPal handles over 20 million transactions daily. Its ease of use and strong brand recognition make it a top business choice.

2. Stripe: Known for its developer-friendly API, Stripe supports over 135 currencies and processes billions of dollars annually, making it ideal for customizable payment solutions.

3. Square: Popular for its easy integration with online stores and POS systems, Square processes billions in transactions and offers transparent pricing with no hidden fees.

4. Authorize.Net: Part of the Visa family, Authorize.Net processes over 1 billion transactions annually. It’s known for strong security features and fraud detection, suitable for businesses of all sizes.

5. 2Checkout (Verifone): Offering support for 87 currencies, 2Checkout handles international transactions seamlessly, making it a popular choice for businesses with global operations.

6. Amazon Pay: Leveraging Amazon’s brand trust, Amazon Pay provides seamless checkout experiences and processes millions of transactions, particularly from Amazon users.

7. Adyen: Adyen supports over 30 currencies and multiple payment methods, processing billions in global payments, and is widely used by tech companies.

8. Braintree: Owned by PayPal, Braintree processes payments in 45+ countries. It offers support for cards, PayPal, Venmo, and even Bitcoin, ideal for diverse payment needs.

9. PaySimple: Tailored for service-based businesses, PaySimple offers robust customer management tools and handles billions in payments for small to medium enterprises.

10. Helcim: Known for transparent pricing, Helcim supports interchange-plus fees, processes payments at low cost, and provides volume discounts for growing businesses.

By selecting one of these top payment gateways for ecommerce, businesses can improve transaction security and streamline the payment process for their customers.

Top Security Tips When Choosing Payment Gateways for Ecommerce

Security is of utmost importance when choosing payment gateways for ecommerce. Selecting a secure payment gateway protects sensitive customer information and reduces the risk of fraud.

PCI Compliance: A Benchmark for Secure Transactions

One of the key factors to consider when evaluating payment gateways for ecommerce is their compliance with the Payment Card Industry Data Security Standard (PCI DSS). The PCI DSS sets a benchmark for handling cardholder data and enforces strict security protocols to protect against breaches.

When choosing a payment gateway for ecommerce, ensure it is PCI-compliant and meets all the requirements. This certification assures that the gateway follows industry best practices and has implemented robust security measures.

Robust Encryption: Safeguarding Sensitive Data with Encryption

Encryption is a vital component of secure payment gateways for ecommerce. It ensures that data transmitted between the customer, merchant, and bank is protected from unauthorized access.

Look for online payment gateways that utilize strong encryption algorithms, such as Secure Sockets Layer (SSL) or Transport Layer Security (TLS), to encrypt and secure data during transmission. Encryption helps prevent interception and tampering of sensitive information and minimizes the risk of data breaches.

Fraud Prevention Measures: Protecting Against Chargebacks and Theft with Advanced Tools

Fraud prevention is a crucial aspect of payment gateway security. Online payment gateways for ecommerce that offer advanced tools and features to detect and prevent fraudulent transactions. These tools may include real-time fraud monitoring, address verification, and CVV verification.

Real-time monitoring identifies suspicious transactions during the payment process, allowing for immediate action. Address verification cross-checks the customer-provided billing address to minimize identity theft risk. CVV verification ensures the customer has physical possession of the credit card by verifying the three-digit security code.

Tokenization: Enhancing Security Without Storing Card Details by Using Tokens

Tokenization is an additional layer of security, gaining popularity in online payment gateways. Tokenization replaces the actual credit card details with a unique token, rendering the card information useless if intercepted by unauthorized individuals. It reduces the risk of data theft.

The payment gateway generates a token representing the card details provided during purchase. This token is stored in the gateway's secure system, while the original card information is not stored. In a data breach, the stolen token would be useless without the original card details.

Tips for Optimizing User Experience (UX) for a Frictionless Checkout

Enhancing the user experience during the checkout process is pivotal in driving successful conversions. A simplified yet multifaceted payment gateway for ecommerce is crucial.

Simplified Checkout Process: Fewer Clicks, More Conversions

Minimizing the number of steps required for customers to complete their purchase, simplifying form fields, and providing clear calls-to-action, can significantly enhance usability. This ultimately leads to improved conversion rates.

With a concise checkout flow, customers are more likely to purchase without hesitation. By focusing on simplicity and removing unnecessary complexities, you can streamline the purchasing journey with effective payment gateways for ecommerce.

Catering to Customer Preferences with Multiple Payment Options

Diversity in payment options is key to accommodating customers' varied preferences. Integrating online payment gateways for ecommerce and offering a comprehensive array of payment methods enhances convenience.

By providing flexibility in payment choices, you align with customer preferences and create a more inclusive and accessible purchasing experience. A diverse range of payment options empowers customers to transact in a manner that best suits their needs.

Streamlining Purchases for New Customers with Guest Options

Incorporating a guest checkout feature eliminates barriers to entry for first-time visitors and streamlines the purchasing process. Customers can complete their purchases without creating an account, creating a frictionless experience that encourages impulse buys and fosters positive initial interactions.

Guest checkout expedites the transaction process and alleviates any potential hesitation or reluctance associated with account creation. By removing this obligation, you reduce friction and welcome new customers with a hassle-free and straightforward pathway to purchase.

Mobile-Friendly Payment Gateways for Ecommerce

As the prevalence of mobile shopping continues to rise, optimizing your online payment gateways for mobile devices is paramount. Embracing responsive design principles ensures your online payment gateways adapt seamlessly to diverse screen sizes and resolutions.

By prioritizing mobile compatibility, you instill confidence in mobile shoppers and transcend the limitations of device type. A mobile-friendly online payment gateway not only enhances accessibility but also demonstrates your commitment to providing a top-tier user experience across all platforms.

Additional Tips for a Successful Online Payment Gateway Integration

A successful online payment gateway integration is pivotal in driving seamless transactions. Here are some essential tips and best practices for integrating an online payment gateway.

Choosing Payment Gateways for Ecommerce that Integrate Seamlessly

When selecting an online payment gateway, prioritizing integration ease and compatibility with your ecommerce platform is paramount. Opt for payment gateways for ecommerce that seamlessly integrates with your existing system. Also, ensure a smooth and efficient setup process without losing compatibility.

Selecting ecommerce payment gateways that align with your platform's architecture and technical requirements streamlines the integration process and minimizes potential disruptions to your online operations.

Choose an online payment gateway that harmonizes with your platform. This will help you build a cohesive and high-performing payment ecosystem.

Recurring Billing Support: Accommodating Subscription Services with Automated Billing

Incorporating payment gateways for ecommerce businesses offering subscription services with recurring billing support is vital. Enabling automated billing for recurring transactions streamlines the subscription management process and minimizes administrative overhead.

Payment gateways for ecommerce equipped with robust recurring billing capabilities empower your business. Online payment gateways can automate payment collection and foster customer loyalty.

With seamless and automated billing, you can optimize the subscription experience for your business and your valued customers, promote retention, and drive long-term revenue growth.

Choosing Payment Gateways for Ecommerce That Grow with Your Business

As your ecommerce business evolves and expands, select payment gateways that offer scalability and accommodate your growth trajectory. Opt for online payment gateways that can scale alongside your business, catering to increasing transaction volumes and evolving payment needs.

Payment gateways for ecommerce with scalability and growth potential position your business for long-term success, allowing you to adapt to changing demands and capitalize on new opportunities. Proactively select payment gateways for ecommerce aligning with your business's growth ambitions.

Conclusion

Payment gateways for ecommerce play a crucial role in ensuring secure and efficient online transactions. To avoid the risk of fraud and breach of sensitive customer information, businesses must prioritize selecting online payment gateways that meet the highest security standards, such as PCI compliance and advanced encryption.

Providing a frictionless and seamless customer experience through a simplified checkout process, multiple payment options, and responsive mobile design is equally vital. Integrate an online payment gateway that aligns with your ecommerce platform's architecture and technical requirements.

The payment gateways for ecommerce must support recurring billing and offer scalability and growth potential. This will position your business for sustained success in the rapidly evolving world of ecommerce.

Frequently Asked Questions (FAQs)

Are PCI compliance requirements mandatory for all payment gateways for ecommerce transactions?

Yes, PCI compliance is crucial for ensuring the secure handling of cardholder data. Compliance helps protect against breaches and ensures payment gateways adhere to stringent security protocols, safeguarding sensitive information.

How does tokenization enhance the security of transactions on online payment gateways?

Tokenization replaces actual card details with unique tokens, rendering stolen data useless. By storing tokens instead of sensitive information, tokenization minimizes the risk of data theft, enhancing security in online transactions.

Why is mobile-friendliness essential for payment gateways for ecommerce platforms?

Optimizing payment gateways for mobile devices is crucial as mobile shopping continues to rise. A mobile-friendly design ensures a seamless checkout experience, enhances accessibility, and fosters customer satisfaction across all devices.

What are the key benefits of incorporating recurring billing support in payment gateways for ecommerce businesses?

Recurring billing simplifies subscription management, minimizes administrative overhead, and enhances customer convenience. It automates payment collection for recurring transactions, streamlining operations and promoting customer loyalty in subscription services.

How can businesses ensure a smooth and secure checkout while maintaining PCI compliance?

Businesses can streamline checkout by prioritizing simplicity, providing multiple payment options, and implementing security measures like encryption and tokenization. Businesses can achieve a secure checkout process by adhering to PCI standards and enhancing user experience.

Table of Contents

- What is a Payment Gateway and Why is it Important for Your Ecommerce Business?

- Top 10 Payment Gateways for Ecommerce in the USA

- Top Security Tips When Choosing Payment Gateways for Ecommerce

- Tips for Optimizing User Experience (UX) for a Frictionless Checkout

- Additional Tips for a Successful Online Payment Gateway Integration

- Conclusion

- Frequently Asked Questions (FAQs)