- Why Digital Onboarding Matters in 2025

- Digital Onboarding Solutions for Banks

- Crafting the Future of Banking with Smart Onboarding

- Frequently Asked Questions (FAQs)

Table of Contents

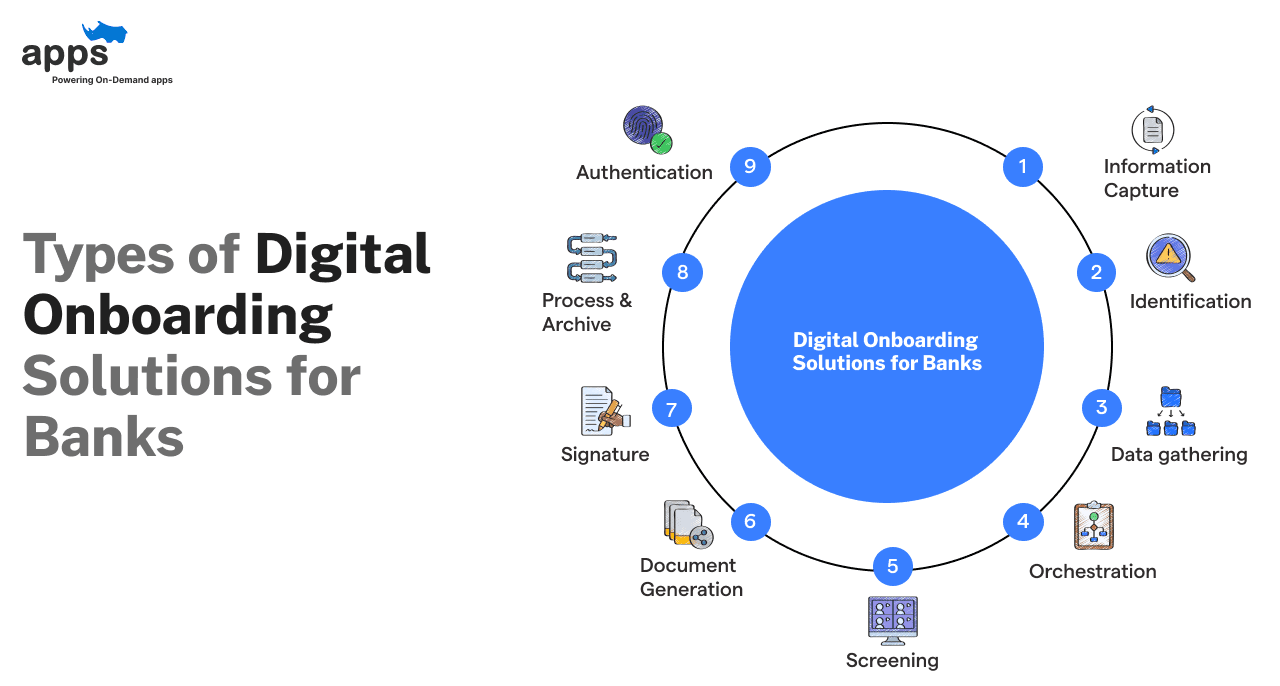

7 Types of Digital Onboarding Solutions for Banks

Digital onboarding solutions for banks let customers open accounts, apply for loans, or access online financial services, removing the need to visit a branch.

These solutions combine technologies like biometric identification, AI-powered fraud detection, e-signatures, chatbots, and mobile-first verification to streamline onboarding.

With digital banking adoption rising globally, offering smooth onboarding has become a competitive advantage.

Over half of the global population is projected to use digital banking by 2026, and 61% of users say they would switch to a digital-first bank if the onboarding were faster and easier. (Source: McKinsey)

Additionally, 90% of all bank interactions will occur through digital channels by 2025.

This blog explores seven types of digital onboarding solutions for banks, explaining how each model addresses specific user needs while improving efficiency and satisfaction.

Why Digital Onboarding Matters in 2025

Banks are no longer just buildings. They're apps, websites, and intelligent platforms where digital onboarding is the new front door.

It's where a potential customer's relationship with a bank truly begins. They may not return if the process feels outdated, time-consuming, or confusing.

In today's hyperconnected landscape, expectations are higher than ever:

"Speed, ease, and trust define a successful onboarding experience in 2025," according to insights from Signicat's report on onboarding trends.

Here's what the data shows:

- 61% of customers are ready to switch to a digital-first bank if onboarding is faster (Source: McKinsey)

- 63% abandon the process if it's too long or complex (Source: Signicat)

- 90% of all bank interactions are expected to happen online by 2025

This isn't just about technology, it's about trust. Customers want reassurance that their data is safe, their experience is smooth, and their onboarding is tailored to their needs.

That's why banks are turning to digital onboarding solutions for banks—integrated systems that reduce fraud, ensure compliance, and personalize the user journey across devices and channels.

What Makes a Great Digital Onboarding Experience?

Let's take a look at the factors.

- A signup process that takes minutes, not hours

- Seamless verification with biometrics and AI-powered tools

- Compatibility with mobile and desktop platforms

- Real-time guidance through chat or support agents

- Transparent privacy and consent flows.

By delivering on these fronts, banks can convert more leads, improve retention, and reduce risk, all while creating experiences that customers want to return to.

Digital Onboarding Solutions for Banks

We will break down the seven most effective digital onboarding solutions for banks, setting the benchmark for success.

1. eKYC (Electronic Know Your Customer)

eKYC is foundational for digital onboarding solutions for banks that replace in-person verification with fast, automated ID checks.

Customers upload photos of their identity documents and selfies using digital onboarding solutions for banks that ensure instant processing and seamless compliance.

The system uses OCR and facial recognition to confirm identity and check for liveness.

Leading platforms like Jumio and Onfido enable this process, and some even support document-free verification by connecting to government ID databases.

Banks can instantly check customer identity against fraud databases and global watchlists, satisfying KYC/AML regulations like FinCEN (U.S.), AMLD5 (EU), and RBI (India).

TransUnion reports that 6.5% of new digital banking accounts trigger fraud alerts, emphasizing the need for robust KYC checks. This solution is proven to reduce both time and cost.

Deloitte notes that India's Aadhaar eKYC initiative cut onboarding costs by ~99%. Digital-first banks like N26, Monzo, and Paytm use eKYC to allow customers to open accounts in minutes

Key Benefits

- Fully remote identity verification in under 2 minutes

- High fraud detection accuracy via real-time document scans

- Compliance-ready architecture for regulated markets

Why it stands out: This method offers banks one of the fastest, most scalable digital onboarding solutions.

It minimizes manual effort while increasing customer satisfaction.

2. Video KYC

Video KYC adds a human layer to the digital onboarding process.

Instead of simply submitting documents, customers interact with a live agent via video. During the session, the agent may ask the user to display an official ID, perform specific gestures like blinking or head turns, or verbally confirm details for identity verification.

This method not only improves fraud protection but also satisfies regulators who require real-time presence verification.

As one of the most trusted digital onboarding solutions for banks, it adds an extra layer of assurance to high-value or sensitive onboarding flows, such as wealth accounts or SME loans.

DBS Bank in Singapore, Monzo in the UK, and Paytm in India all use video KYC.

The Reserve Bank of India also officially recognizes video KYC as a compliant onboarding approach.

Key Benefits

- Offers real-time support and verification without needing a branch visit

- Reassures users through live interaction, improving trust

- Works well for high-value or regulated accounts

Why it stands out: In markets where personal interaction matters, video KYC bridges the digital-physical gap. It is a powerful addition to digital onboarding solutions for banks seeking compliance and customer engagement.

3. Self-Service Onboarding Portals

Self-service portals are web-based platforms where customers can complete the onboarding journey independently. These portals are ideal for customers who want control and convenience.

As part of broader digital onboarding solutions for banks, they empower users to manage their onboarding without needing intervention from bank staff.

They allow users to upload required documents, fill out forms at their own pace, and digitally sign agreements—all without scheduling a call or visiting a branch.

ICICI Bank's InstaOD portal allows business owners to apply for credit lines in minutes.

According to Forrester, 77% of customers prefer self-service digital options over branch visits.

Key Benefits

- Always-on access improves convenience.

- Reduced operational costs and manual data entry

- Easily integrates with KYC engines and CRM platforms.

Why it stands out: They are handy for retail banking and SMEs. These users often require quick turnaround without human interaction. Real-time data validation and auto-save features improve accuracy and reduce drop-off.

4. Mobile App Onboarding

Mobile app onboarding allows users to complete the signup process from their smartphones.

This is especially important in a mobile-first world where users expect everything to be available through an app.

As one of the most widely adopted digital onboarding solutions for banks, mobile apps make it easy for customers to fill out forms, take ID photos, record verification selfies, and receive real-time feedback on whether they've submitted the correct information.

Native app features like camera access, face recognition, GPS, and push notifications are used to streamline the experience.

Leading digital banks such as Chime, HSBC, and ICICI provide complete onboarding flows through their mobile apps.

According to Statista, 1.75 billion people use mobile banking worldwide, and 76% of American adults rely on mobile apps for daily banking.

Key Benefits

- Serves users in rural or underbanked areas without internet access

- Appeals to Gen Z and millennials who prefer mobile interaction

- Reduces paperwork and speeds up KYC workflows

Why it stands out: Mobile onboarding is the centerpiece of digital onboarding solutions for banks looking to serve a mobile-first customer base.

5. Chatbot-Based Onboarding

Chatbot-based onboarding guides users through their application using an AI-powered conversation. Customers interact with a digital assistant that asks simple, structured questions and explains form requirements in real-time.

As part of modern digital onboarding solutions for banks, this format reduces friction and confusion, especially for first-time users or those unfamiliar with financial products.

According to PwC, 80% of millennials prefer digital interactions, and chatbot onboarding meets that expectation by being conversational, fast, and always available.

BotPenguin enables banks to deploy customizable chatbot workflows. Bank of America's Erica is one of the most recognized banking bots, handling millions of customer interactions.

Key Benefits

- Step-by-step guidance with smart clarifications

- Minimal training is needed for users.

- Lower abandonment rates due to real-time help

Why it stands out: Chatbots work 24/7 and can be deployed in web apps, mobile platforms, and even messaging services like WhatsApp.

6. Branchless Onboarding with eSignature

Branchless onboarding with eSignature lets banks complete the entire account setup or loan disbursement process digitally.

After completing eKYC or video verification, the customer receives the necessary documents electronically and signs them online using secure e-signature tools.

Platforms like DocuSign, Adobe Sign, and Aadhaar eSign ensure authentication through OTPs, audit trails, and timestamped consent. These digital signatures are legally recognized under the U.S. ESIGN Act, EU's eIDAS, and India's IT Act, enabling banks to serve customers remotely without sacrificing regulatory compliance.

This method benefits small business accounts, mortgage applications, and long-term financial agreements.

According to Deloitte, digital document handling and e-signing significantly reduce onboarding time and cost while improving completion rates.

Key Benefits

- Eliminates paper-based delays and manual errors

- Shortens time-to-customer for credit approvals and contracts

- Enhances customer convenience with 24/7 access

Why it stands out: As one of the more process-intensive digital onboarding solutions for banks, it enables institutions to handle complex documentation entirely online.

7. Assisted Digital Onboarding

Assisted digital onboarding blends automation with a human touch. In this model, a bank employee guides the customer through the onboarding journey through video call, co-browsing, or in-person assistance with a tablet-based interface.

This approach is ideal for users who are uncomfortable navigating digital forms or have unique financial needs.

A 2024 ABA survey highlights that 13% of Baby Boomers prefer assisted onboarding, compared to just 4% of Gen Z. By offering optional help, banks avoid drop-offs among underserved demographics.

Banks like Barclays allow users to book virtual or physical onboarding support appointments, offering a tailored experience that aligns with customer comfort levels.

Key benefits

- Improves accessibility and customer trust

- Reduces form errors with guided support

- Converts hesitant or high-value prospects who need assurance

Why it stands out: As part of inclusive digital onboarding solutions for banks, it ensures that whether helping an elderly user upload documents or walking a high-net-worth client through multi-layered verification, the model delivers precision and personal support.

Crafting the Future of Banking with Smart Onboarding

Every customer is different, and their onboarding experience should reflect that.

As digital-first banking becomes the norm, banks must implement scalable, secure, and intelligent digital onboarding solutions for banks that simplify compliance and elevate the user experience.

From automated eKYC to video verification, chatbots, and human-assisted sessions, these solutions reduce abandonment rates, improve compliance, and serve customers across generations.

Whether a Gen Z user applying from a mobile app or a senior citizen needing personal support, modern onboarding can meet them where they are.

Platforms like BotPenguin make it easier to roll out tailored workflows fast. But if you're looking for an all-in-one platform that simplifies everything from UI to compliance, AppsRhino is your best bet.

AppsRhino helps banks launch secure, scalable, and intuitive onboarding systems—supporting mobile apps, ID verification, consent capture, and fraud detection—all in one place\

Start your transformation today with AppsRhino. Deliver seamless, compliant, and customer-first digital onboarding solutions for banks.

Frequently Asked Questions (FAQs)

What is onboarding in AML KYC?

It refers to verifying customer identity, checking against sanctions lists, and assessing risk before account approval. This ensures regulatory compliance and prevents money laundering.

What is a digital-first approach in banking?

It means banks prioritize mobile apps and online services over physical branches. This shift is essential to deliver modern, scalable digital onboarding solutions for banks.

How do digital onboarding solutions for banks help reduce fraud?

They use biometric checks, AI risk scoring, and document validation to block fake identities and ensure secure account opening.

Can digital onboarding solutions for banks be personalized for users?

Yes. Banks can tailor onboarding journeys for individuals, businesses, or VIPs by adjusting form complexity, verification layers, and product flows.

What technologies power digital onboarding solutions for banks?

Facial recognition, OCR, liveness detection, and e-signature tools enable secure and automated onboarding. These tools form the tech foundation of digital onboarding solutions for banks.

Table of Contents

- Why Digital Onboarding Matters in 2025

- Digital Onboarding Solutions for Banks

- Crafting the Future of Banking with Smart Onboarding

- Frequently Asked Questions (FAQs)