- Key Facts & 2024-2025 Summary

- Revenue and User Growth: Detailed Yearly Analysis

- Geographic Expansion & Partner Network

- Competitive Context: DoorDash vs Uber Eats

- User Demographics & Behavior

- Industry Trends Shaping Uber Eats

- Regulatory Factors and Their Impact

- How AppsRhino Can Help You Create an App Like Uber Eats?

- Conclusion

- Frequently Asked Questions (FAQs)

Table of Contents

Uber Eats Statistics & Market Analysis 2026

Since launching, Uber Eats has transformed the global food delivery ecosystem. As of 2026, it serves millions worldwide, generating billions in revenue, while navigating fierce competition, technological innovation, and evolving consumer behaviors.

This article offers an in-depth statistical overview and market analysis of Uber Eats, blending quantitative data with strategic insights to illuminate where the food delivery giant stands and where it’s heading.

Key Facts & 2024-2025 Summary

- $13.7B revenue recorded in 2024, reflecting continued strong growth despite saturation.

- Active user base grew from 10 million in 2017 to 95 million by 2024, highlighting global adoption.

- Holds 23% of U.S. market share, second only to DoorDash’s dominant 56%.

- Expanding rapidly: over 11,500 cities and 1.2 million restaurant partners globally.

- Became profitable in 2023, unusual for aggregators in a typically cash-burning industry.

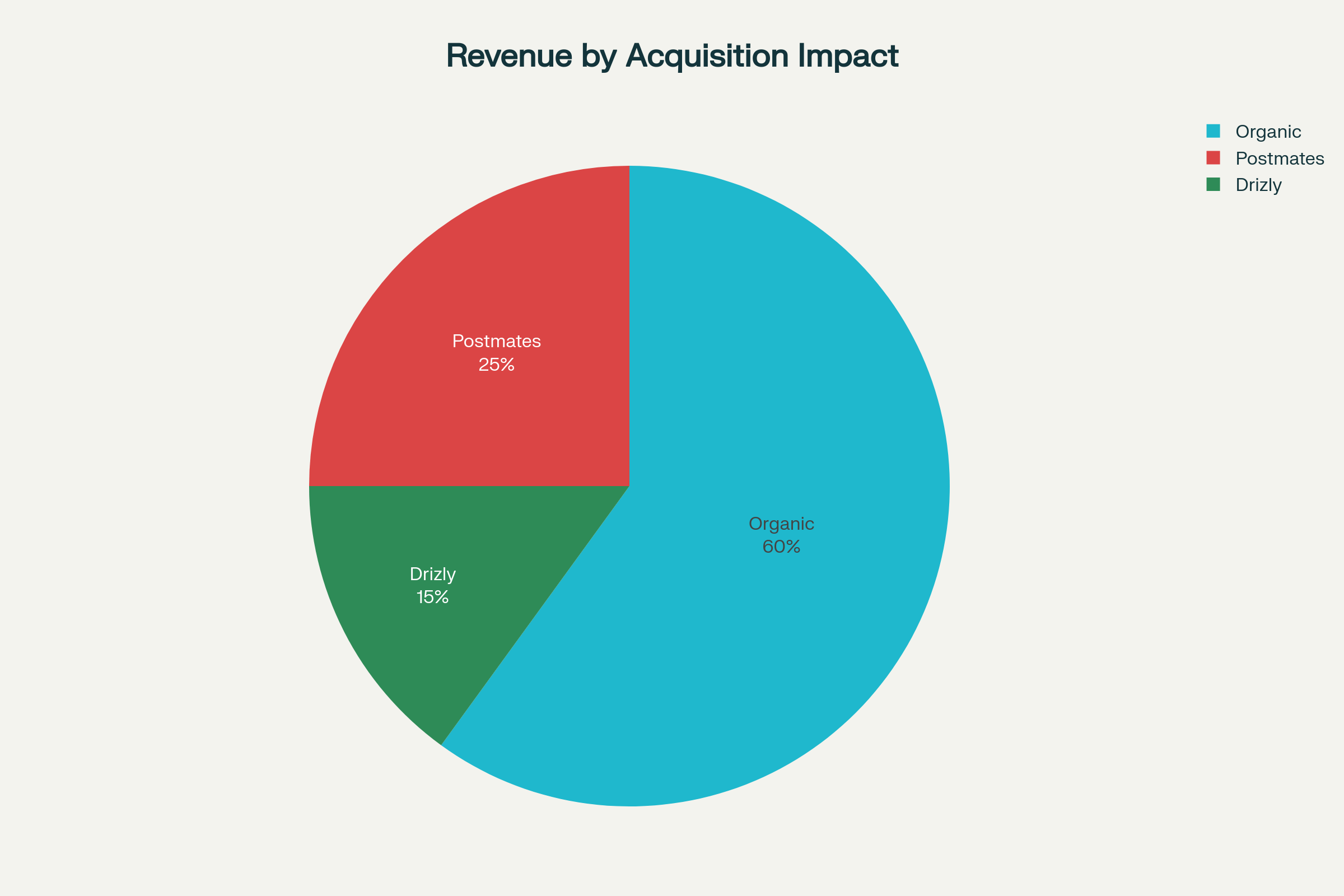

- Absorbed Postmates and the former Drizly alcohol delivery platform, integrating new verticals.

- Strategic focus extending into grocery delivery partnerships (Costco, Carrefour) and quick commerce.

- Facing new regulatory environments, including delivery taxes impacting pricing models.

Revenue and User Growth: Detailed Yearly Analysis

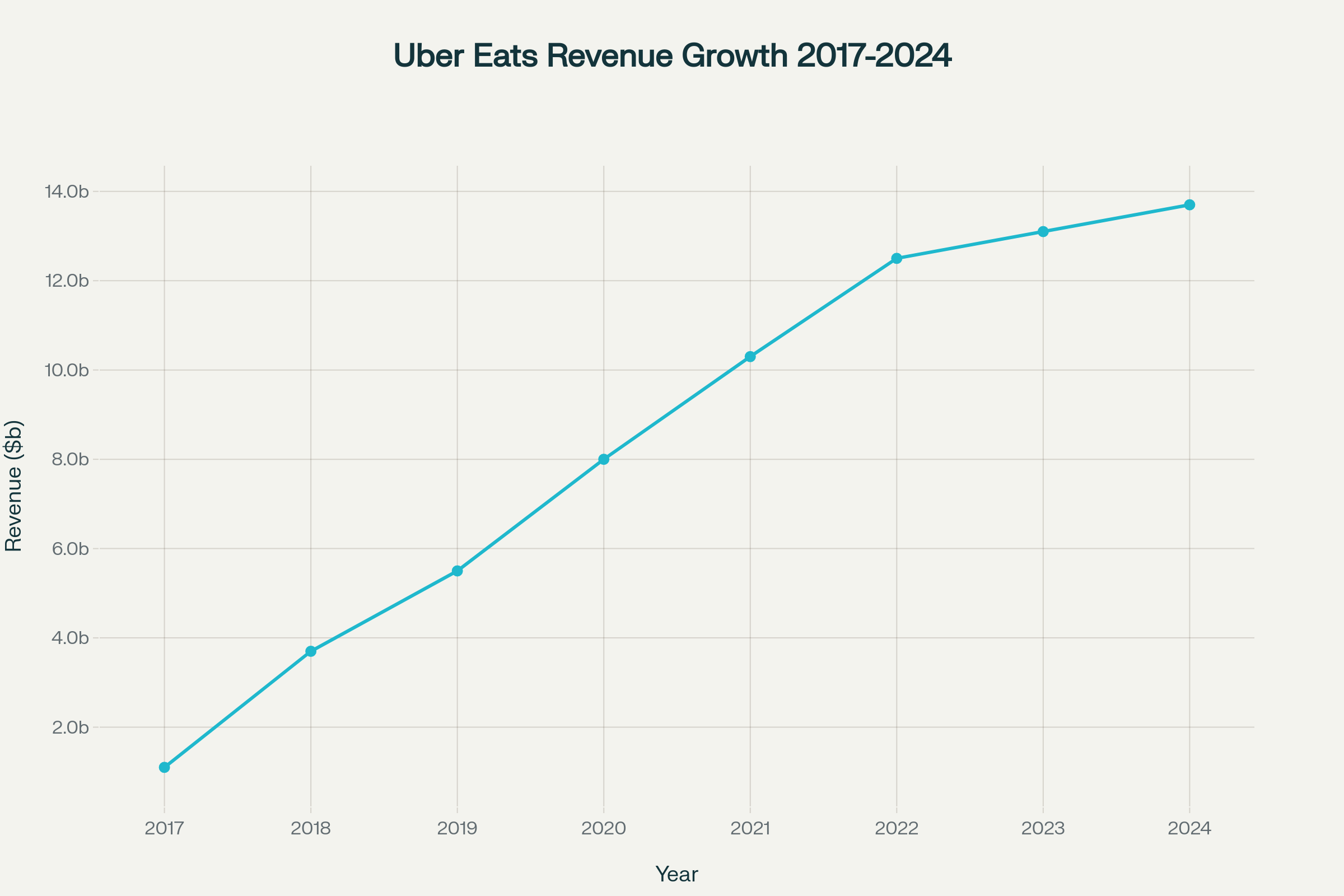

The food delivery market has witnessed explosive growth, fueled by urbanization, smartphone penetration, and changing lifestyles. Uber Eats’ revenue rose dramatically from $1.1 billion in 2017 to $13.7 billion in 2024 (projected), supported by increasing order volumes and expanded service areas.

| Year | Revenue (USD B) | Active Users (Million) | Market Share (U.S.) |

|---|---|---|---|

| 2017 | 1.1 | 10 | 15% |

| 2019 | 5.5 | 35 | 18% |

| 2021 | 10.3 | 70 | 21% |

| 2023 | 13.1 | 90 | 22.5% |

| 2024* | 13.7 | 95 | 23% |

Projections based on Q1 2024 data

Multiple US and global market expansions drove user acquisition and revenue gains, despite slightly slowing growth rates typical of mature markets. International adoption has been a key differentiator, with Uber Eats leading in several major markets where DoorDash is absent.

Geographic Expansion & Partner Network

From a few hundred cities in 2017 to over 11,500 in 2024, Uber Eats' geographic footprint has grown aggressively. This broad coverage, paired with partnerships with over 1.2 million restaurants, allows Uber Eats to offer unparalleled choice and convenience.

- Major food cities worldwide now rely heavily on Uber Eats for delivery.

- Expansion into grocery services and convenience retail accelerates, especially in urban areas.

- Partnering with major retailers (Costco, Carrefour) positions Uber Eats as a lifestyle platform, not just food delivery.

Competitive Context: DoorDash vs Uber Eats

DoorDash dominates the U.S. market with a 56% share, while Uber Eats holds about 23% and commands stronger global revenues, and it is innovating in key segments like quick commerce.

| Metrics | Uber Eats (2024) | DoorDash (2024) |

|---|---|---|

| Revenue | $13.7B | $24.1B |

| Market Share (US) | 23% | 56% |

| Active Users | 95M | 130M |

| Profitability | Profitable (2023) | Profitable (2022) |

| Key Acquisitions | Postmates, Drizly | Caviar, Wolt |

Uber Eats is focusing on operational efficiency, tech-driven customer experiences, and international expansion to counter DoorDash’s dominant position in the U.S.

User Demographics & Behavior

Uber Eats’ user base skews younger, tech-savvy, and urban-centric:

- Approximately 74.5% of users are between 18 and 44 years old.

- Millennials and Gen Z drive higher order frequency, favoring convenience and app usability.

- Heavy weekend and evening usage patterns dominate orders.

- Increasing demand for grocery and essential delivery.

Understanding these trends informs Uber Eats’ tailored marketing and product development strategies to deepen engagement.

Industry Trends Shaping Uber Eats

- Rapid growth in grocery delivery: The grocery e-commerce market is projected to exceed $1.28 trillion by 2028, with Uber Eats aligning through partnerships to tap this lucrative segment.

- Quick commerce and 30-minute deliveries redefine user expectations and urban logistics, driving investment in local micro-fulfillment centers.

- AI and Data Usage: Advanced AI-powered algorithms optimize delivery routes, predict demand surges, and personalize customer recommendations, improving efficiency and satisfaction.

- Sustainability: Initiatives toward greener packaging and e-vehicle fleets respond to consumer demands and regulatory pressures.

Regulatory Factors and Their Impact

Uber Eats faces challenges from evolving regulatory frameworks:

- Recent proposals of delivery-specific taxes in states like Illinois may increase consumer costs.

- Changes in gig worker classifications impact delivery partner flexibility and operational costs.

- Automobile emission standards and labor laws require adaptive logistics and workforce strategies.

The company’s ability to respond proactively to regulation is crucial to maintaining competitive pricing and service quality.

Global Market Position

While the U.S. remains vital, Uber Eats has positioned itself as a global leader:

- Leading in revenue in international markets such as France, Japan, and Australia.

- Ranked among the top 3 in Brazil and major European regions.

- Aggressively expanding into emerging markets in South America and Asia to access new user bases.

Profitability and Future Outlook

- Uber Eats achieved profitability by 2023, a significant milestone in a historically cash-intensive sector.

- EBITDA improvements come from cost control, premium service tiers, and increased order volume.

- The focus moves to sustainable growth with AI-driven innovations and diversification beyond traditional meal deliveries.

Challenges Ahead:

- Intensifying competition, particularly from agile niche players and giants like DoorDash.

- Maintaining the balance between driver compensation, operational costs, and customer pricing.

- Navigating regulatory complexity globally without compromising growth.

How AppsRhino Can Help You Create an App Like Uber Eats?

In today’s competitive food delivery landscape, building a robust, scalable, and user-friendly app like Uber Eats requires cutting-edge technology and deep market insight. AppsRhino specializes in developing custom on-demand delivery apps tailored to your business needs. Leveraging low-code platforms and AI-powered features, AppsRhino enables businesses to accelerate their app development cycle with:

- Seamless User Experience: Intuitive interface design inspired by market leaders to ensure high engagement and easy navigation.

- Advanced Features: Real-time GPS tracking, efficient order management, multi-payment gateways, and AI-enabled personalized recommendations.

- Scalability & Performance: Infrastructure designed to handle high traffic, multi-region operations, and integration with third-party APIs for restaurants and delivery.

- Cost & Time Efficiency: Low-code development accelerates building and deploying your app, reducing costs without compromising quality.

- Ongoing Support & Updates: Continuous maintenance and enhancement post-launch to adapt to evolving market trends and customer expectations.

Partnering with AppsRhino means gaining access to expert development resources that can replicate and customize the key functionalities of Uber Eats while embedding your unique business requirements, accelerating your entry into the booming delivery market.

Conclusion

Uber Eats has solidified its position as one of the top players in the global food delivery market by 2025, demonstrating robust revenue growth, extensive user adoption, and significant market penetration. With $13.7 billion in revenue and 95 million active users projected in 2024, the platform continues to expand its footprint aggressively both domestically and internationally.

Despite facing intense competition from DoorDash, which holds a commanding 56% of the U.S. market, Uber Eats leverages strategic acquisitions, technological innovation, and partnerships to sustain growth and profitability.

The platform’s move into grocery and quick commerce, coupled with operational efficiencies driven by AI and data analytics, fuels its future growth trajectory. However, regulatory challenges such as delivery taxes and evolving labor laws present headwinds.

Overall, Uber Eats’ ability to adapt to market dynamics, invest in new verticals, and emphasize sustainability positions it well for continued industry leadership and innovation in the coming years.

Frequently Asked Questions (FAQs)

What percentage of revenue does Uber Eats take?

Uber Eats typically takes 15% to 30% commission from restaurants per order, depending on factors like delivery distance, order size, and partnership agreements.

How many users use Uber Eats?

As of 2025, Uber Eats has over 85 million active users worldwide, making it one of the leading food delivery platforms in terms of reach and engagement.

What is the revenue model of Uber Eats?

Uber Eats earns through commissions from restaurants, delivery fees, surge pricing, subscription plans (Uber One), and advertising placements on its app and website.

What is the most used food delivery app?

DoorDash is currently the most used food delivery app, holding the largest U.S. market share, followed by Uber Eats, Grubhub, and Postmates.

Table of Contents

- Key Facts & 2024-2025 Summary

- Revenue and User Growth: Detailed Yearly Analysis

- Geographic Expansion & Partner Network

- Competitive Context: DoorDash vs Uber Eats

- User Demographics & Behavior

- Industry Trends Shaping Uber Eats

- Regulatory Factors and Their Impact

- How AppsRhino Can Help You Create an App Like Uber Eats?

- Conclusion

- Frequently Asked Questions (FAQs)