- Introduction

- What is an Automated KYC Solution?

- How Does Automated KYC Work?

- Types of KYC Verification in Automation

- Key Features of Automated KYC Systems

- Benefits of Using Automated KYC

- Use Cases Across Industries for Automated KYC Solutions

- Challenges and Limitations in Using Automated KYC Solutions

- Compliance and Global Standards for Automated KYC Solutions

- How to Choose the Right Automated KYC Provider

- The Future of KYC Automation Solutions

- Why an Automated KYC Solution Is Essential for Growth

- Frequently Asked Questions (FAQs)

Table of Contents

What is Automated KYC Solution? Everything You Need to Know

Introduction

Know Your Customer (KYC) compliance means verifying a customer’s identity, address, and risk profile to prevent fraud, money laundering, and terrorist financing. Traditionally, KYC is done manually with customers submitting IDs and paperwork, which is slow and error-prone.

Banks spend millions on these checks – one survey found large institutions spending up to $35 million annually to onboard 10,000 customers. (Source: Fenergo)

With 71% of consumers now using online or mobile banking on a weekly basis, financial institutions are under pressure to streamline the onboarding process. (Source: Gitnux) Companies can slash processing time and reduce errors by adopting an automated KYC solution.

An automated KYC solution replaces manual tasks with AI, machine learning, biometrics, and OCR. Decision-makers often assess an automated KYC solution by quantifying its automated KYC benefits, such as cost savings and improved accuracy.

In heavily regulated sectors like banking, KYC automation for banks is increasingly seen as a competitive necessity.

This article explains what an automated KYC solution is, how it works, and highlights its key features, automated KYC benefits, and challenges. You’ll also learn how to choose the right provider and what trends to watch in KYC automation.

What is an Automated KYC Solution?

An automated KYC solution uses software to streamline identity verification. Instead of manual data entry and paper checks, the system automatically collects and analyzes customer information.

It combines multiple technologies to handle KYC tasks quickly: scanning IDs, validating documents, and checking databases. With this approach, human error is reduced and data is captured in seconds.

- Minimizes manual data entry and significantly reduces human errors.

- Verifies identity using ID documents, biometrics, and official databases.

- Screens customers against sanctions, PEP lists, and fraud registries.

- Accelerates onboarding by automating key compliance verification steps.

- Maintains accurate, consistent, and audit-ready verification records.

- Adapts quickly to regulatory changes across different jurisdictions.

- Enhances audit readiness with automated logging and reporting tools.

In practice, the automated KYC solution acts as a digital compliance officer. It extracts ID data via OCR and matches it to live selfies for every applicant, updating audit logs automatically.

For example, if a customer changes their address, the system can instantly re-verify it and record the change.

By centralizing these processes, an automated KYC solution ensures every customer is verified consistently and efficiently, freeing compliance staff to focus on high-risk cases. Many providers deliver automated KYC as a cloud service with easy APIs so institutions can deploy it without heavy IT projects.

Some systems even provide mobile SDKs so customers can verify identity on their phones. In short, an automated KYC solution reduces operational burden and frees analysts to focus on complex cases rather than routine data entry.

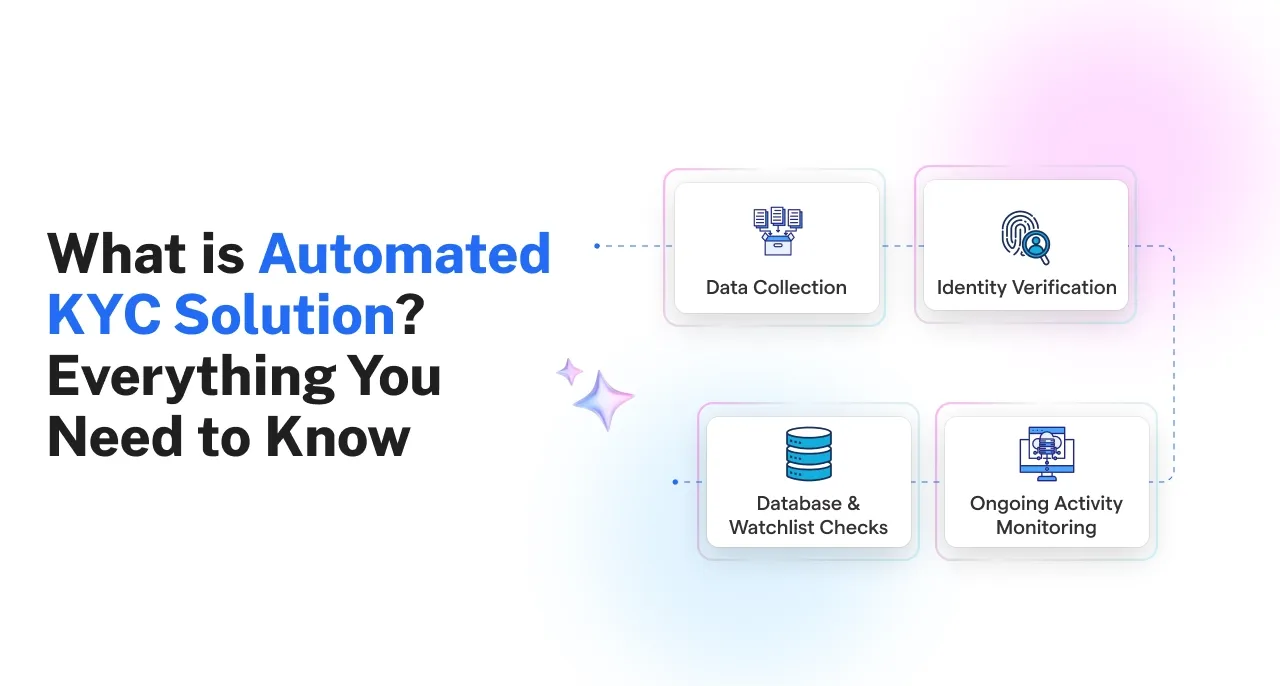

How Does Automated KYC Work?

Automated KYC combines multiple verification steps into one seamless digital process, including document scanning, biometric checks, database screening, and risk scoring, enabling fast, accurate, and compliant onboarding without manual intervention or paperwork.

- Data Capture and OCR: Customers upload ID documents (e.g., passport, driver’s license). Optical Character Recognition (OCR) extracts text from images in seconds. Security features (UV ink, holograms, MRZ codes) are also verified.

- Identity Verification: The software compares the extracted ID data to the user’s face photo or live selfie. Facial recognition or fingerprint/iris matching confirms that the person is who they claim to be.

- Database & Watchlist Checks: In real time, the system runs background checks against official databases (sanction lists, PEP registries, credit bureaus) and internal records. Any matches or red flags are reported immediately.

- Risk Scoring: An intelligent engine assigns a risk score based on the customer’s profile, transaction patterns, and other factors. High-risk customers (e.g., politically exposed persons, unusual activity) are routed for additional review.

- Ongoing Monitoring: The solution can continuously monitor customer profiles even after onboarding. It periodically re-checks information or watches for behavioral changes to ensure ongoing compliance.

Each step is automated to reduce manual workload. Machine learning improves fraud detection by learning from new data.

For instance, imagine a user signing up on a banking app.

- The user uploads a passport photo and captures a live selfie.

- The software extracts document data and verifies the facial match instantly.

- Sanctions lists and databases are checked silently in the background.

- If no red flags are detected, the system approves the account automatically.

This illustrates why an automated KYC solution is so valuable: tasks that once took days and hundreds of dollars per customer now happen in moments.

In fact, by automating all these steps, a medium-sized bank could save thousands of manual work hours per year. The automated workflow speeds onboarding and improves data quality, since information is captured digitally with fewer errors.

Compliance teams typically combine this automation with occasional manual reviews for flagged cases, ensuring speed gains do not compromise oversight.

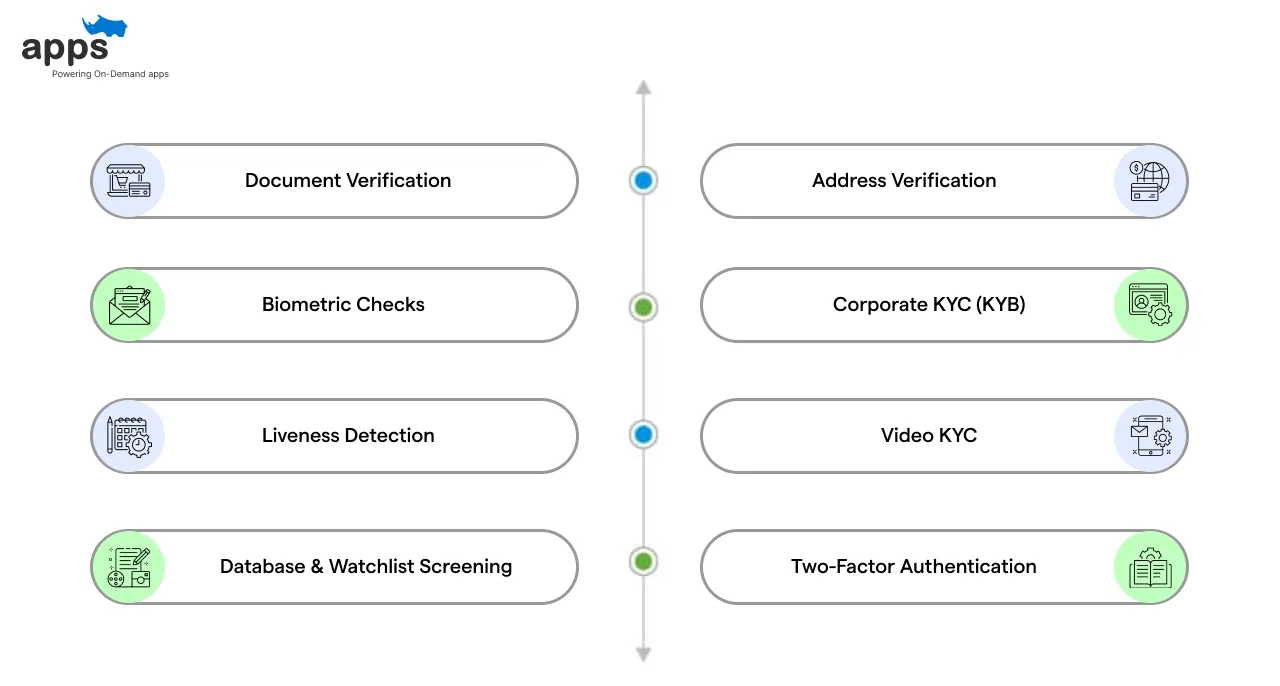

Types of KYC Verification in Automation

Automated KYC solutions use different verification types to meet diverse compliance needs.

These include document scanning, biometrics, video KYC, and database checks, helping organizations validate identities quickly, reduce fraud, and ensure adherence to global and local regulations.

- Document Verification: Scans identity documents (passport, driver’s license, national ID) to verify authenticity. The software checks security features and reads text via OCR.

- Biometric Checks: Compares a live selfie or video of the person with the photo on the ID. Facial recognition, and sometimes fingerprint or iris scans, ensure the user is genuine.

- Liveness Detection: Asks users to blink, smile, or turn their head in a short video to prove they are not submitting a static photo. This thwarts spoofing attacks like printed photos or deepfakes.

- Database & Watchlist Screening: Automatically checks names and IDs against global sanctions lists (OFAC, EU, UN), politically exposed person (PEP) registries, and fraud databases.

- Address Verification: Validates addresses through utility bills, credit bureau data, or government records to ensure the customer lives where they claim.

- Corporate KYC (KYB): Verifies businesses by checking company registration documents, ownership structures, and beneficial owners.

- Video KYC: A live video interview session (required in some regions) where the customer shows documents on camera. AI analyzes the video to match faces and voices.

- Two-Factor Authentication: Sends a one-time code to the user’s phone or email to confirm possession of that contact point and reduce impersonation risk.

For example, KYC automation for banks might combine document scanning and selfie capture into one app flow, followed by automatic watchlist screening. The flexibility of these methods allows institutions to tailor checks by risk level and comply with regional rules.

By layering verification types, companies achieve both strong security and fast processing.

Key Features of Automated KYC Systems

Modern automated KYC platforms offer advanced features like OCR, biometrics, risk scoring, and real-time database checks.

These tools work together to streamline identity verification, enhance fraud detection, ensure compliance, and deliver faster, more secure onboarding across various industries and regions.

- Optical Character Recognition (OCR): Extracts text from ID documents, reducing manual input.

- Biometric Matching: Confirms identity using facial recognition or fingerprint algorithms.

- Liveness Checks: Detects spoofing by analyzing real-time user expressions and movements.

- Watchlist & Sanctions Screening: Checks names against OFAC, EU, UN, and other global lists.

- Machine Learning: Enhances fraud detection and lowers false positives using data insights.

- Risk Scoring Engine: Assigns low, medium, or high-risk scores for quick decision-making.

- Multi-Channel Access: Supports onboarding via web, mobile apps, and self-service kiosks.

- Digital Audit Trail: Automatically records all verification steps for compliance tracking.

- Real-Time Alerts: Notifies teams instantly about flagged activity or suspicious behavior.

- Global Document Library: Recognizes ID types from multiple countries for broader coverage.

- API Integration: Easily connects with banking, CRM, and e-commerce platforms.

These capabilities ensure an automated KYC solution is accurate, efficient, and compliant. OCR quickly captures license data, and biometric engines match faces in milliseconds. A risk engine flags high-risk profiles immediately, and sanction screens update daily.

This means institutions can deploy all checks on one integrated platform. Many solutions are offered as cloud services, so banks and fintechs can adopt advanced KYC without building new infrastructure.

Industry research notes that banks increasingly adopt automated KYC solutions with advanced scanning and AI for real-time identity verification.

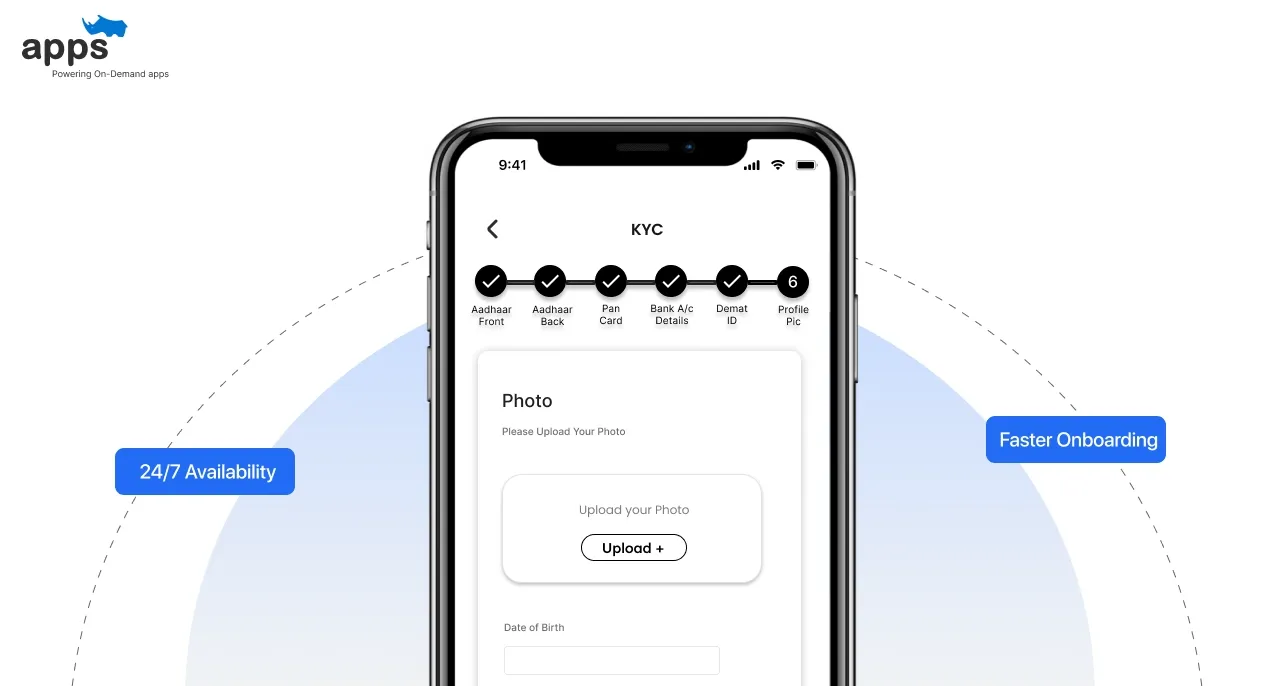

Benefits of Using Automated KYC

Automated KYC solutions offer significant advantages by streamlining identity verification, improving accuracy, and reducing manual effort.

These benefits help businesses onboard customers faster, lower operational costs, enhance compliance, and scale effortlessly while delivering a smoother and more secure user experience.

- Faster Onboarding: Automated checks reduce signup time to minutes, improving conversion rates.

- Lower Costs: Slashes manual labor expenses; automation can cut KYC costs dramatically (some firms report 80% savings).

- Enhanced Accuracy: Consistent application of rules reduces human errors and duplicate effort.

- Better Compliance: Built-in global AML/KYC rules and watchlists ensure consistent screening, reducing regulatory risk.

- Improved Customer Experience: A smooth digital process boosts satisfaction and trust, reducing drop-offs (63% of users abandon slow onboarding).

- 24/7 Availability: Verification runs round-the-clock without human intervention, enabling instant global service.

- Scalability: Easily handles high volumes and seasonal peaks as your business grows.

- Fraud Reduction: Thorough automated checks (biometrics, AI anomaly detection) catch impersonators and fake documents.

- Consistent Processes: Every customer follows the same steps, ensuring fairness and full auditability.

- Data Security: Encryption and secure protocols protect personal data and documents during verification.

- Performance Metrics: Dashboards provide real-time stats on success rates, failures, and processing time.

- Customizable Rules: Companies can adjust risk thresholds and steps by customer segment or region.

These automated KYC benefits translate into real savings. A McKinsey study reports that eKYC can reduce onboarding costs by up to 90%, delivering massive efficiency gains. (Source: McKinsey)

Automated processes also reduce errors: poor KYC compliance has led banks to pay billions in fines.

By eliminating manual work, organizations cut overhead and avoid costly mistakes. In short, investing in an automated KYC solution drives faster growth, higher customer satisfaction, and lower compliance risk – a powerful return on investment.

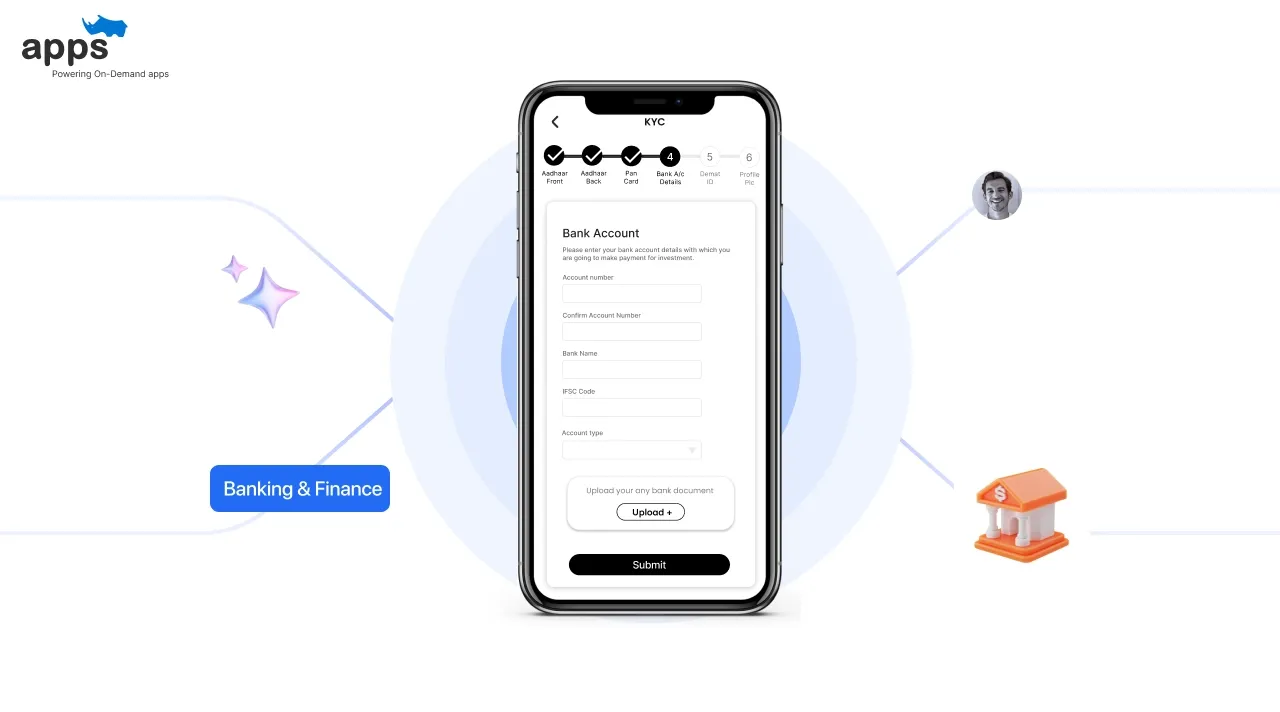

Use Cases Across Industries for Automated KYC Solutions

Automated KYC solutions are widely adopted by medium to large enterprises across industries.

These systems help organizations meet regulatory requirements, prevent fraud, and accelerate onboarding by verifying customer identities quickly and accurately through digital processes tailored to specific sector needs.

- Banking & Finance: Banks and fintechs use KYC automation to speed up account openings, loan approvals, and compliance checks with minimal manual effort.

- Insurance: Insurers verify policyholders’ identities quickly during onboarding and claims processing, reducing fraud and paperwork.

- Fintech & Payments: Payment platforms, digital wallets, and neobanks verify users across borders to meet regulatory requirements while providing instant service.

- Cryptocurrency & Blockchain: Crypto exchanges, ICOs, and DeFi platforms require identity checks to comply with AML laws and build trust.

- Real Estate: Property portals and brokers vet tenants and buyers to prevent money laundering in rentals and purchases.

- Telecom: Mobile operators and ISPs use KYC for SIM card registration, prepaid top-ups, and identity checks for new service accounts.

- Healthcare: Patient portals and telemedicine apps verify patients’ identities to protect sensitive medical records and insurance claims.

- E-commerce: Marketplaces and high-value retailers verify customers for big-ticket sales and returns to reduce fraud.

- Government & Public Sector: E-government services, welfare programs, and tax authorities verify citizen identities and benefit applicants.

- Energy & Utilities: Providers verify customers when setting up electricity, water, or gas accounts to prevent fraudulent registrations.

- Education: Online universities and testing centers verify student identities to ensure exam integrity and valid certifications.

These examples show how an automated KYC solution adapts to different needs. For instance, a UK bank may use a video KYC step to comply with FCA rules, while an Indian telecom might integrate Aadhaar-based verification.

In each case, automation saves time and ensures compliance. Whether a large bank or a fintech startup, organizations leverage KYC automation to reduce manual work and focus on growth.

Challenges and Limitations in Using Automated KYC Solutions

While powerful, automated KYC solutions come with specific challenges. These include data privacy concerns, integration with legacy systems, false positives, regulatory variations across regions, and the need for human oversight.

Addressing these ensures smooth, secure, and compliant implementation at scale.

- Data Privacy: Collecting personal data and biometrics triggers GDPR, CCPA, and other privacy laws. KYC data must be stored and processed securely, often requiring local data residency.

- False Positives/Negatives: No system is perfect. Some legitimate customers may be flagged incorrectly, while some fraudulent attempts might evade automated checks.

- Integration Complexity: Legacy IT systems and diverse channels make deployment complicated and time-consuming.

- Regulatory Differences: Each country or sector may have unique KYC rules. One solution must adapt to EU rules, US laws, and other local requirements.

- Deployment Cost: Building and integrating an automated KYC platform can require significant upfront investment.

- Document Quality: Poor scans or outdated documents can reduce accuracy, requiring backup manual processes.

- Algorithm Bias: AI models must be trained on diverse data to avoid unfair results for specific groups.

- Explainability: AI-driven decisions must remain transparent, as regulators often demand clear audit trails on flagged customers.

- Staff Training: Employees need training on using the system and reviewing exceptions to ensure it is used effectively.

- Vendor Security: Companies should require KYC providers to have strong certifications (ISO 27001, SOC 2) and protocols.

- Constant Updates: Sanctions lists and ID formats change often. The system needs regular data updates and maintenance.

- Technical Reliability: The software must be highly available; downtime can halt new customer onboarding.

Companies can effectively implement an automated KYC solution by addressing these issues, combining computerized checks with human review when needed, and demanding robust security standards.

After all, the goal is to enhance security and compliance. The average cost of a data breach in finance is ~$55 million, so rigorous protection of KYC data is essential.

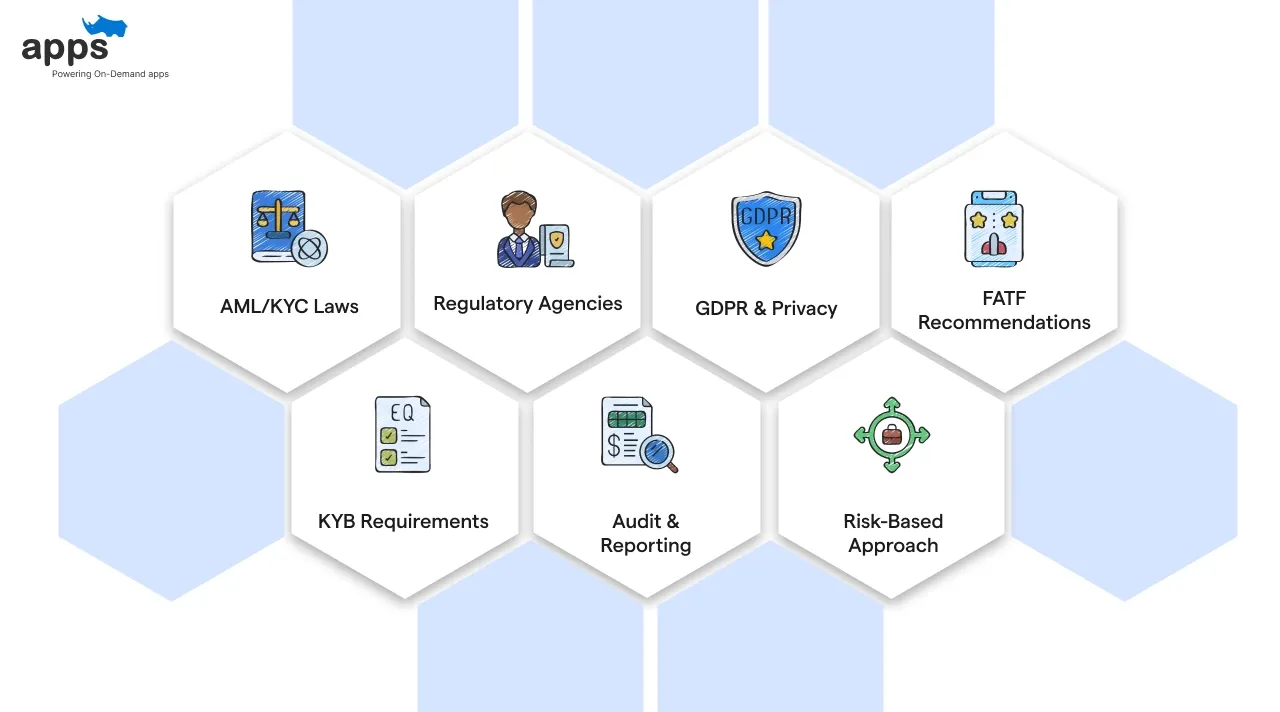

Compliance and Global Standards for Automated KYC Solutions

Automated KYC solutions operate within strict regulations to ensure global compliance. They must adhere to AML laws, data protection standards like GDPR and CCPA, and financial authorities' guidelines.

These rules shape how identity data is collected, verified, and stored.

- AML/KYC Laws: They must meet rules like the USA PATRIOT Act, EU AML Directives, and the UK’s Money Laundering Regulations.

- Regulatory Agencies: Guidelines from bodies like FinCEN (US), FCA (UK), RBI (India), SAMA (Saudi Arabia), and MAS (Singapore) dictate KYC requirements.

- GDPR & Privacy: European and UK data protection laws govern how customer data and documents are handled.

- FATF Recommendations: Global KYC/AML standards set by the Financial Action Task Force provide a risk-based framework.

- KYB Requirements: Verifying businesses and beneficial owners is mandatory in many corporate accounts.

- Audit & Reporting: Automated logs and records help meet regulators’ record-keeping requirements during audits.

- Risk-Based Approach: Companies must tailor KYC intensity to customer risk profiles, as global guidelines require.

An automated KYC solution is typically built to address these standards. For example, AppsRhino’s platform continuously updates sanction lists and offers detailed audit reports on demand.

This ensures that businesses in any country can demonstrate compliance with local and international regulators, from FinCEN requirements in the US to GDPR in the EU.

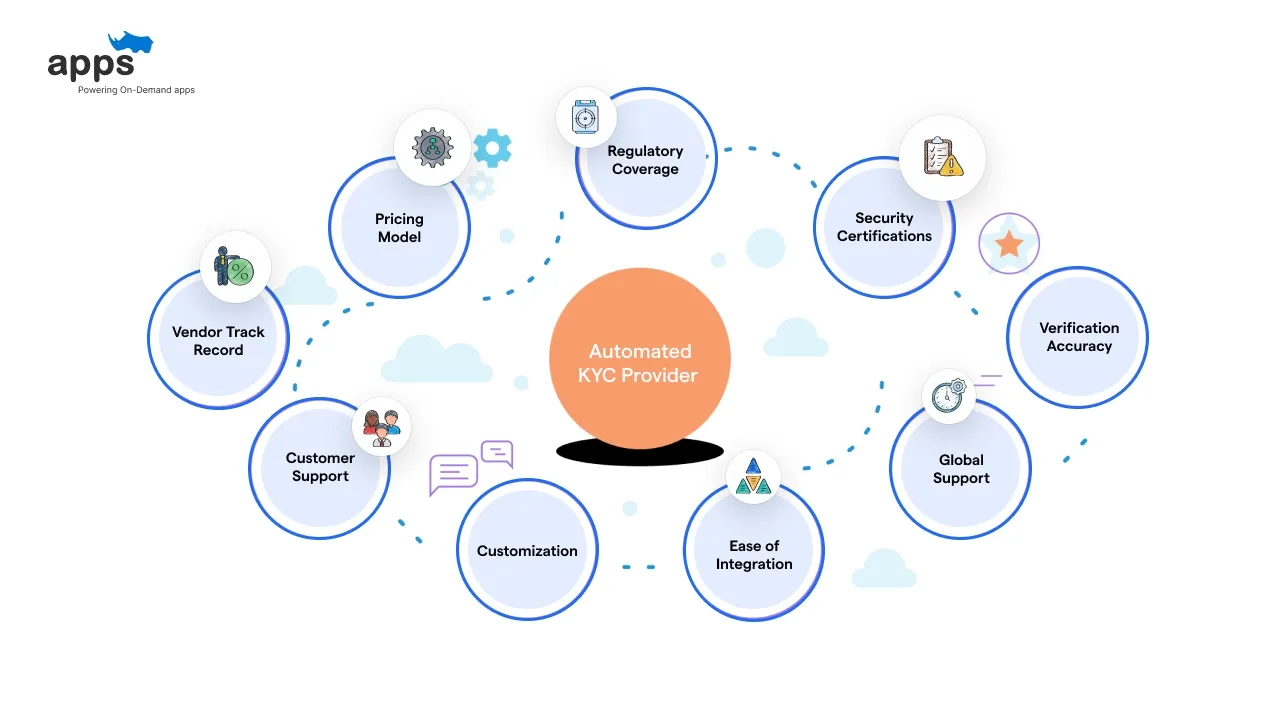

How to Choose the Right Automated KYC Provider

When selecting an automated KYC provider, consider several key factors to ensure reliability and compliance.

These include regulatory coverage, security standards, verification accuracy, global document support, integration ease, scalability, customer support, pricing structure, and the provider’s industry reputation.

- Regulatory Coverage: Ensure the solution covers all required KYC/AML regulations and data sources for your markets.

- Security Certifications: Look for ISO 27001, SOC 2, or similar compliance to protect data.

- Verification Accuracy: Ask for performance metrics on ID and facial checks to gauge reliability.

- Global Support: Confirm it handles documents and languages for all the countries you operate in.

- Ease of Integration: Check for robust APIs, SDKs, and plugins to connect with your web/mobile apps and backend.

- Customization: Ability to tailor workflows, risk rules, and user experience to your needs.

- Scalability: The system should handle your current and future volume without performance issues.

- Customer Support: 24/7 technical and compliance support helps resolve issues quickly.

- Pricing Model: Transparent cost structure (per-check, subscription, or tiered) aligned with usage.

- Vendor Track Record: Proven success in similar industries (banking, fintech, insurance) and global deployments.

Evaluate each option based on expected automated KYC benefits. Request demos and ask vendors to show the whole user flow.

A strong provider (like AppsRhino) will support global compliance needs and integrate smoothly with your systems, ensuring a fast, secure onboarding process.

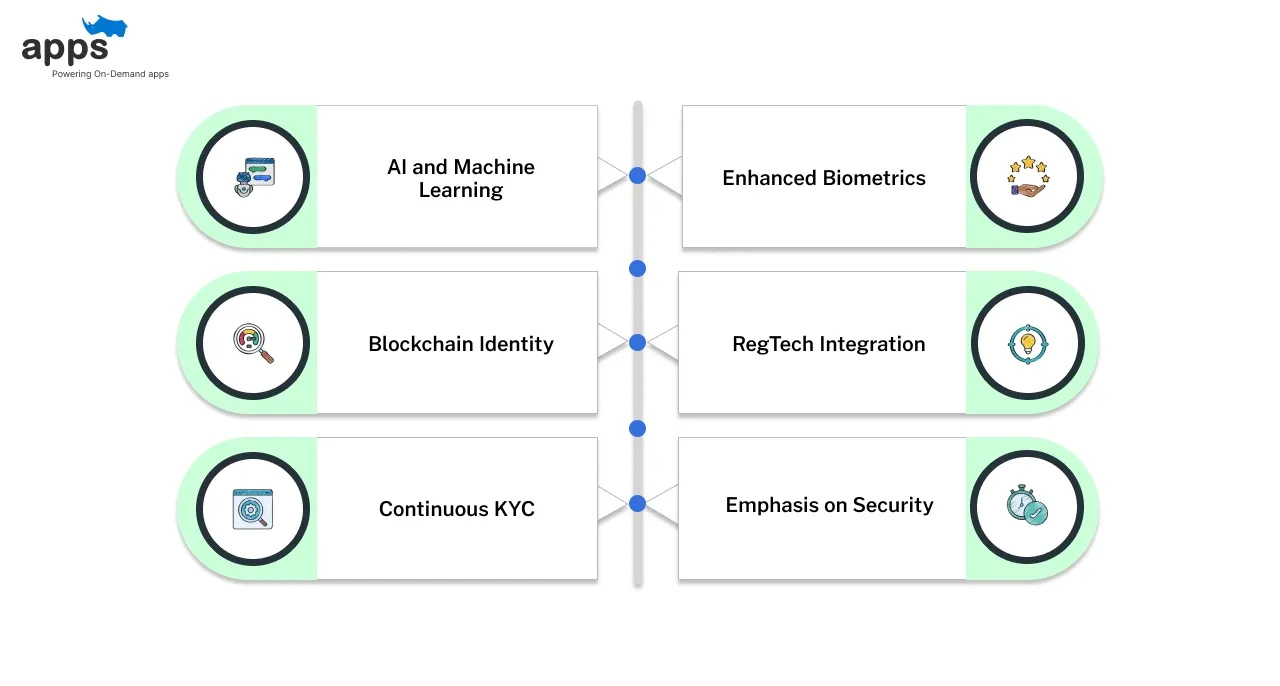

The Future of KYC Automation Solutions

The future of KYC automation will be shaped by technology and evolving regulations.

Advancements like AI, blockchain, reusable digital IDs, and continuous monitoring will drive smarter, faster verification, while global standards push for more transparency, data security, and user-centric compliance models.

- AI and Machine Learning: Smarter algorithms will catch subtle fraud patterns and reduce false flags. AI may even predict risky behavior before it occurs.

- Blockchain Identity: Decentralized digital IDs allow users to reuse verified identities across platforms, reducing the need to re-verify for each service.

- Continuous KYC: Ongoing monitoring (perpetual KYC) will become standard, automatically alerting to customer risk profile changes.

- Enhanced Biometrics: Beyond facial recognition, we’ll see more use of iris, voice, and behavioral biometrics for stronger verification.

- RegTech Integration: Automated regulatory updates and compliance alerts will keep KYC systems up to date with the latest laws.

- Wider Adoption: More sectors like telecom, real estate, and e-commerce will implement KYC automation, driven by tighter regulations.

- User-Centric Models: Users may carry digital credentials (self-sovereign ID) they control and share as needed, streamlining verification.

- Global Digital ID Programs: National or regional digital ID initiatives (like e-government IDs) will simplify KYC for companies that integrate with them.

- Emphasis on Security: Future solutions will improve encryption and fraud prevention as cyber threats evolve.

Analysts predict rapid growth. For example, Juniper Research forecasts the global automated KYC solutions market will reach $16.7 billion by 2026, reflecting broad adoption.

This shows that KYC automation for banks and other firms will keep becoming more intelligent, integrated, and essential for compliance.

Why an Automated KYC Solution Is Essential for Growth

Automated KYC solutions offer companies a powerful way to verify customers quickly, accurately, and at scale. By replacing manual checks with digital processes, organizations gain faster onboarding, lower costs, and stronger compliance.

These automated KYC solution advantages are critical for banks, fintechs, insurers, and real estate firms in the US, UK, and the Middle East.

AppsRhino provides an advanced automated KYC solution tailored to your needs. Our platform combines ID scanning, biometric verification, and real-time watchlist screening into one integrated service.

Why Choose AppsRhino for Your Automated KYC Solution

- Automates KYC end-to-end with secure digital identity verification tools.

- Ensures compliance with AML, GDPR, FATF, and global regulations.

- Integrates easily using flexible APIs and developer-friendly SDKs.

- Detects fraud in real-time with AI and biometric technology.

- Supports your team 24/7 and scales with your business growth.

Learn more about how AppsRhino can transform your KYC process with a personalized demo today.

Frequently Asked Questions (FAQs)

How long does it take to implement an automated KYC solution?

Implementation time varies based on integration needs but typically ranges from a few days to weeks, especially if the provider offers ready-to-use APIs and SDKs.

Can automated KYC solutions detect deepfakes or synthetic identities?

Yes. Advanced systems use AI-powered liveness detection and biometric analysis to spot deepfakes, printed images, and synthetic fraud attempts with high accuracy.

What types of documents are typically supported in automated KYC?

Most solutions support global IDs like passports, driver's licenses, national IDs, utility bills, and bank statements, depending on the regulatory requirements in your country.

Do automated KYC systems require internet access for verification?

Yes. A stable internet connection is essential for processing since it relies on real-time data checks, sanctions list updates, and cloud-based algorithms.

Is video KYC mandatory for all regions or industries?

No. Video KYC is required only in specific jurisdictions (like India for regulated financial entities) but is optional elsewhere, depending on risk and compliance requirements.

Table of Contents

- Introduction

- What is an Automated KYC Solution?

- How Does Automated KYC Work?

- Types of KYC Verification in Automation

- Key Features of Automated KYC Systems

- Benefits of Using Automated KYC

- Use Cases Across Industries for Automated KYC Solutions

- Challenges and Limitations in Using Automated KYC Solutions

- Compliance and Global Standards for Automated KYC Solutions

- How to Choose the Right Automated KYC Provider

- The Future of KYC Automation Solutions

- Why an Automated KYC Solution Is Essential for Growth

- Frequently Asked Questions (FAQs)