- Introduction

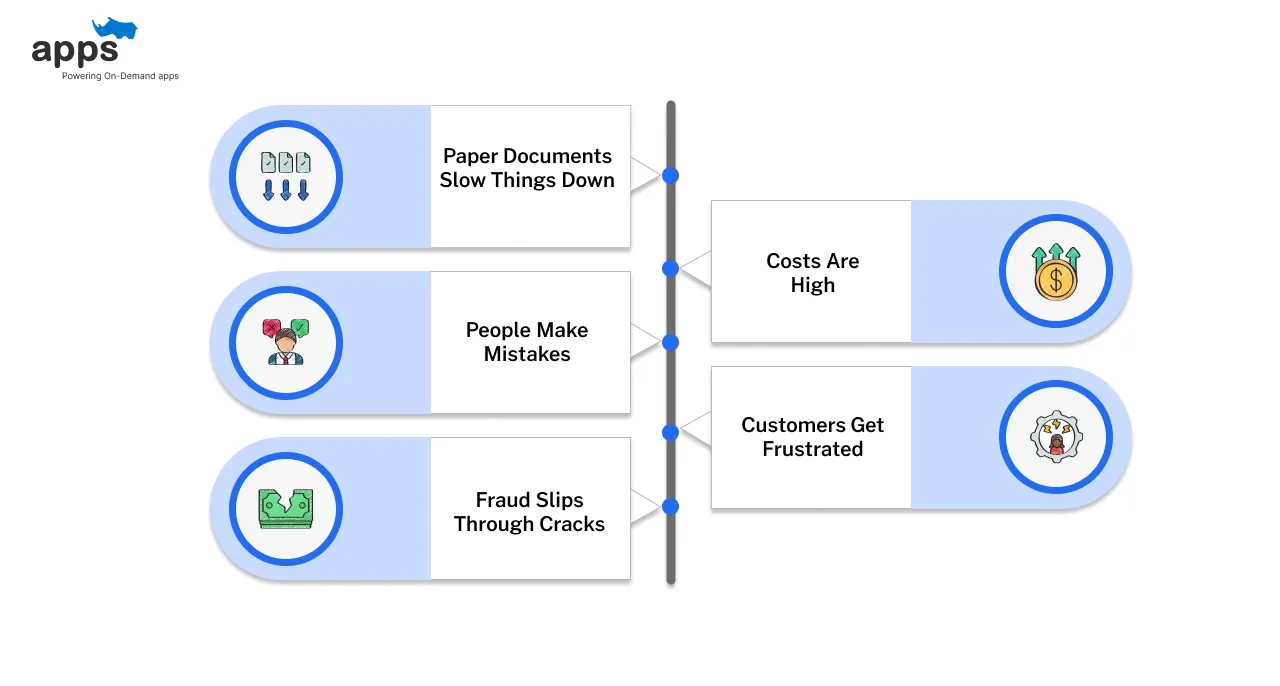

- The Challenges of Manual KYC: Why It No Longer Works

- What Is AI in KYC Automation?

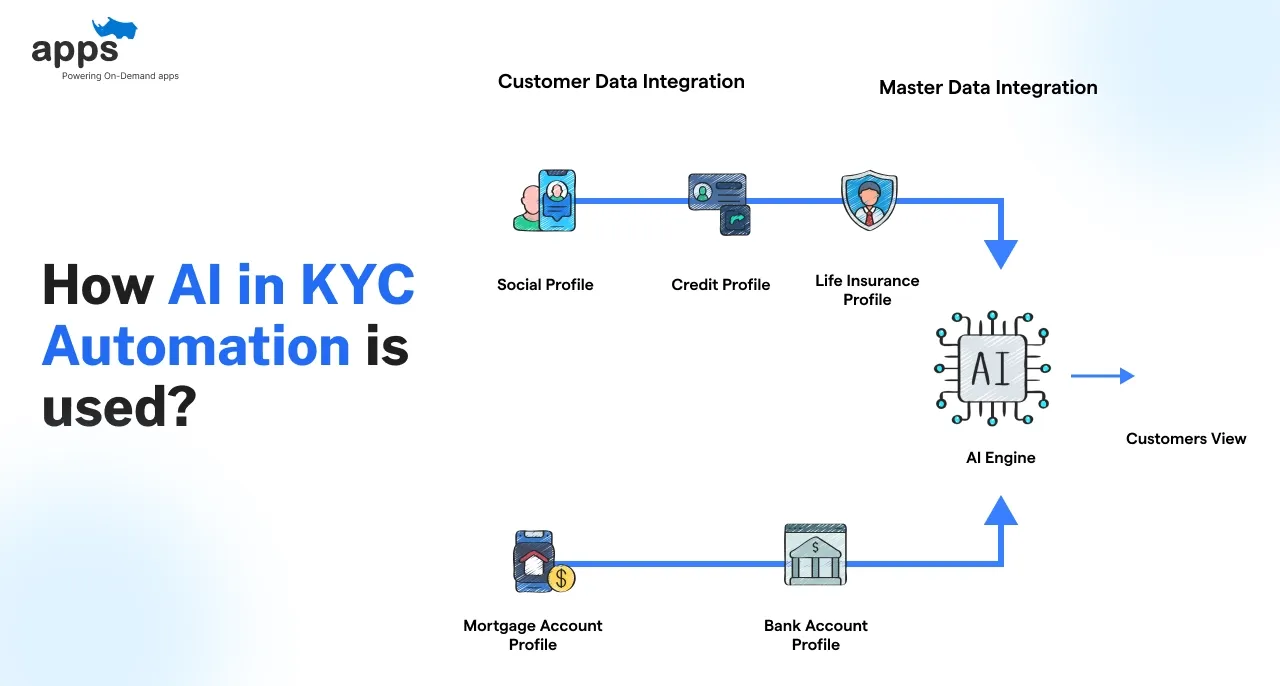

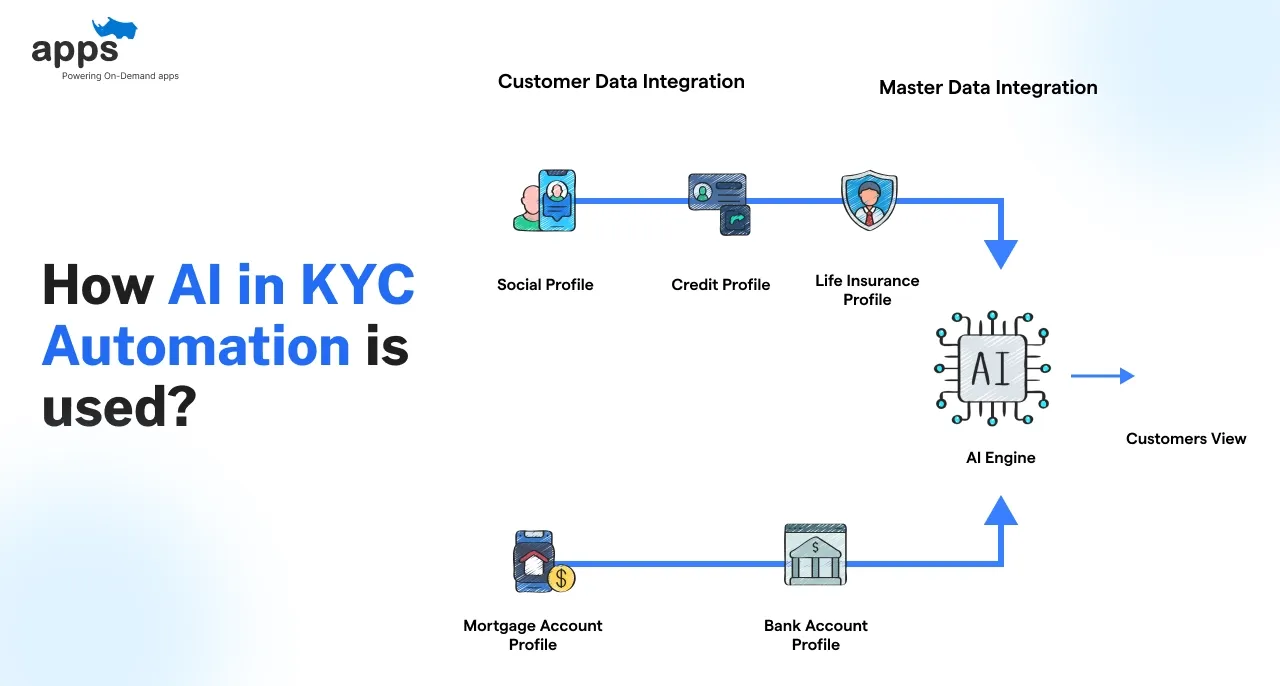

- How AI Is Used in KYC Automation?

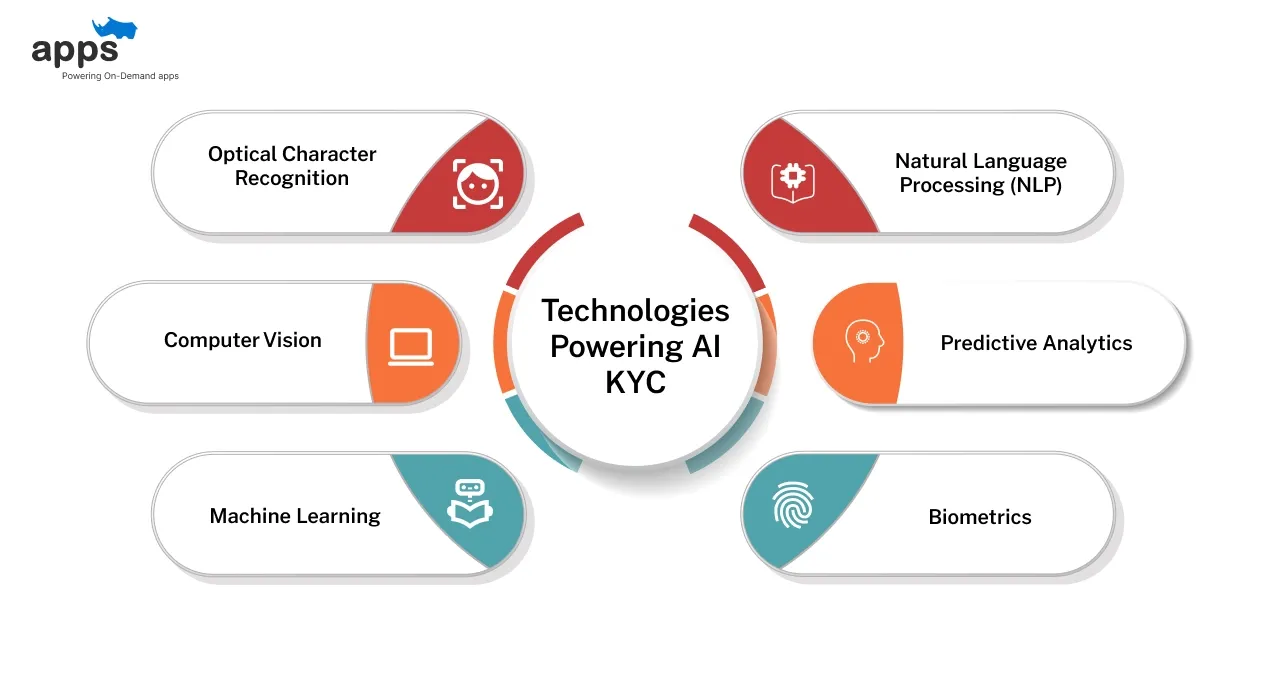

- Technologies Powering AI KYC

- Benefits of AI in KYC

- Risks and Considerations

- The Future of AI KYC

- More Advanced AI Tools

- Tighter Regulations

- Conclusion

- Frequently Asked Questions (FAQs)

Table of Contents

How AI in KYC Automation is used?

Introduction

Your passport photo might know more about you than your banker ever will.

It sounds strange, but it’s true.

Today, machines can look at your ID, check your face, and decide if you’re a fraud risk—all in seconds.

You don’t need a person to scan every document or approve every form.

This is possible because of AI.

AI doesn’t just help with simple checks. It learns patterns, detects fake documents, and flags risky behavior more quickly than any human.

This guide shows how AI is used to automate KYC. And why it’s changing trust forever.

The Challenges of Manual KYC: Why It No Longer Works

Manual KYC processes often seem straightforward but hide many hidden pitfalls that slow down business and frustrate customers.

Paper Documents Slow Things Down

Think about a small lender verifying a customer’s identity with scanned ID cards. Each document has to be printed, signed, and archived. The process can take 10–20 business days, potentially delaying approvals. In a world where people expect instant apps and same-day services, this lag feels prehistoric.

People Make Mistakes

Even experienced compliance teams can mistype a birth date or miss a mismatched address. A 2023 Thomson Reuters report found that human errors contribute to 30% of KYC delays. These slip-ups often lead to repeated checks and lost trust with customers.

Fraud Slips Through Cracks

Fraudsters use high-quality fake IDs that look real to the naked eye. Manual reviews can’t always detect subtle inconsistencies or synthetic identities. This is where AI in KYC Automation shows its edge, analyzing hidden patterns in milliseconds. Without it, companies risk fines and damage to their brand.

Costs Are High

Maintaining large verification teams, physical storage, and repetitive reviews drains budgets. McKinsey estimates that manual KYC costs can exceed $50–$150 per customer. These expenses compound as regulations tighten each year.

Customers Get Frustrated

When people are asked to resubmit documents or wait weeks, they often walk away. A 2024 Signicat study showed over 60% of customers abandoned onboarding due to delays. Digital-first users expect seamless experiences, not old-fashioned bottlenecks.

Modern businesses increasingly turn to kyc automation to avoid these pitfalls. By automating verification, you speed up onboarding, reduce costs, and meet rising customer expectations—all without sacrificing compliance.

What Is AI in KYC Automation?

AI in KYC Automation refers to using intelligent software to handle tasks that humans traditionally perform during identity verification. Think of it as a digital assistant that can see a document, read the details, compare them with databases, and decide if the information is valid—all in moments.

For example, when a customer submits their ID for verification, AI systems analyze it for authenticity by detecting subtle features like holograms or font inconsistencies—tasks that are time-consuming and prone to error when done manually.

AI naturally fits KYC processes because these tasks are repetitive and data-intensive. Unlike humans, AI doesn’t get tired or distracted. It quickly scans thousands of applications, flags suspicious patterns, and ensures compliance with ever-changing regulations. A recent report by Juniper Research indicates that banks utilizing AI-powered KYC solutions reduce onboarding time by over 70% while simultaneously reducing fraud losses by nearly 25%.

The evolving regulatory environment demands constant updates, and AI adapts faster than manual teams. This flexibility makes kyc automation an essential tool for businesses aiming to stay compliant without sacrificing speed or accuracy.

For more expert insights, Deloitte’s analysis on AI and KYC transformation highlights the growing impact of these technologies.

In summary, AI in KYC Automation transforms identity verification from a slow, error-prone chore into a fast, reliable, and scalable process that benefits both businesses and customers alike.

How AI Is Used in KYC Automation?

The power of AI in KYC Automation lies in its ability to handle complex tasks quickly and accurately. Let’s explore the main ways AI transforms the KYC workflow with real-world examples.

Data Capture: Instant Extraction of Key Details

AI uses Optical Character Recognition (OCR) to scan ID documents and forms. Instead of manual typing, AI reads names, dates, and document numbers directly from images.

For instance, when a user uploads a passport photo, AI extracts the data instantly, even from worn or low-quality documents. This reduces onboarding time by over 60%, according to industry reports.

This speed and accuracy eliminate human errors that often cause delays in manual kyc automation processes.

Identity Verification: Matching Faces and Checking Authenticity

AI compares the photo on an ID to a live selfie using facial recognition technology. It detects subtle differences to prevent fraud, such as distinguishing between a real person and a photo on a screen.

At the same time, AI verifies the document’s authenticity by checking security features like holograms or microtext—tasks that are tedious for humans but routine for AI.

A major European bank reported a 45% drop in identity fraud after implementing AI-powered verification.

Screening Against Watchlists: Lightning-Fast Compliance Checks

AI scans names against global sanction lists, politically exposed persons (PEPs), and blacklists. What took hours manually now happens in seconds.

For example, AI-powered systems like those from Refinitiv cross-check millions of records automatically, flagging risky customers instantly. This rapid screening prevents onboarding individuals who pose regulatory or reputational risks.

Risk Scoring: Smarter Fraud Detection with Machine Learning

AI uses machine learning models to score customers by their risk level. It analyzes patterns such as transaction history, device fingerprints, and behavioral data to identify suspicious activity.

For example, fintech startups use risk scoring to flag accounts with unusual login locations or high-value transfers, focusing human review where it counts. This approach can reduce false positives by up to 30%, improving efficiency and user experience.

Ongoing Monitoring: Continuous Watch After Onboarding

KYC is not a one-time check. AI continuously monitors customer transactions post-onboarding. If AI detects anomalies like sudden spikes in activity or transactions from unusual locations, it sends alerts for investigation.

HSBC employs AI monitoring tools that analyze millions of daily transactions, helping them detect money laundering attempts faster than traditional methods.

Technologies Powering AI KYC

The success of AI in KYC Automation depends on several powerful technologies working together. Each plays a crucial role in making identity checks faster and more reliable.

Optical Character Recognition (OCR)

OCR lets AI quickly read text from IDs and forms. Picture a customer uploading a passport photo that’s a bit crumpled. OCR scans and extracts important details like name and date of birth accurately—even when the text is faint or tilted. This cuts down manual typing errors and speeds up onboarding.

Computer Vision

Computer vision helps AI “see” beyond text. It analyzes images to detect fake documents or identify security features such as holograms. For example, AI can spot if an ID photo is actually a picture of a screen, preventing fraud that slips past human eyes.

Machine Learning

Machine learning enables AI to learn from data patterns. It scores customers by risk level based on transaction history and behavior. Banks using this tech report up to a 30% reduction in fraud cases, as AI detects suspicious activity earlier and more accurately than traditional checks.

Natural Language Processing (NLP)

NLP enables AI to comprehend unstructured text, such as customer responses or handwritten notes. For example, it can flag inconsistencies or unusual wording in application forms, speeding up risk detection and reducing false alarms.

Predictive Analytics

Predictive analytics uses past data to forecast potential risks. It helps firms act before fraud happens. According to Accenture, businesses leveraging predictive analytics cut financial crime losses by nearly 25%, highlighting its growing importance in kyc automation.

Biometrics

Biometrics — including facial recognition and fingerprint scans — confirm identities using unique physical traits. This adds a strong layer of security, making impersonation nearly impossible and building trust in the digital onboarding process.

Benefits of AI in KYC

AI in KYC Automation is transforming how businesses verify identities, delivering clear benefits across the board.

Faster Onboarding

Imagine a customer opening a digital bank account. Traditional checks can take days. AI speeds this up by instantly verifying documents and identities. A report from Juniper Research shows onboarding times can drop by up to 70% with AI-powered systems.

Lower Costs

Manual verification means hiring large teams and handling physical paperwork. Automating these tasks with AI slashes operational costs significantly. McKinsey estimates banks reduce onboarding expenses by nearly 50% using kyc automation.

Better Fraud Detection

AI spots subtle fraud patterns humans might miss. For example, it can detect fake IDs or suspicious behaviors faster and more accurately. According to Deloitte, AI-enhanced fraud detection improves accuracy by 30%, protecting businesses from costly risks.

Less Manual Work

By automating repetitive checks, AI frees up compliance teams to focus on complex cases. This improves employee satisfaction and reduces burnout, leading to better overall efficiency.

Risks and Considerations

While AI in KYC Automation offers many benefits, it also brings important risks and challenges that businesses must address carefully.

Data Privacy

AI systems handle sensitive personal data, from IDs to transaction histories. Protecting this data is crucial. For example, mishandling biometric information could lead to serious privacy breaches. Firms must comply with laws like GDPR and implement strong encryption and access controls.

Bias in Algorithms

AI models learn from historical data, which can embed biases. If unchecked, this may cause unfair treatment of certain groups during identity checks. A 2023 MIT study revealed that some facial recognition tools had higher error rates for minority populations. Regular audits and diverse training data are essential to minimize bias in kyc automation.

Compliance with Regulations

Regulatory requirements are complex and evolving. Automated systems must stay updated to meet local and international rules. Failure to comply can lead to hefty fines. According to a 2024 Deloitte report, continuous monitoring and human oversight remain key to effective AI in KYC Automation.

The Future of AI KYC

The future of AI in KYC Automation looks promising with rapid advancements and wider industry adoption.

More Advanced AI Tools

AI is evolving beyond basic document checks. New tools will use deep learning to detect even the most sophisticated fraud attempts. For example, emerging AI can analyze behavioral biometrics like typing patterns to verify identities invisibly and securely.

Tighter Regulations

As AI-driven systems grow, regulators worldwide are updating rules to ensure fairness and privacy. Companies must keep pace with evolving standards like the EU’s Digital Identity Wallet framework to maintain compliance while leveraging AI benefits.

Wider Adoption Across Industries

Originally strong in banking and finance, kyc automation is expanding to sectors like healthcare, insurance, and telecommunications. These industries face growing identity risks and are adopting AI to streamline onboarding and reduce fraud.

According to a 2024 Gartner report, 80% of large organizations plan to increase their investment in AI-powered KYC solutions over the next two years, signaling the momentum of this trend.

Conclusion

AI is revolutionizing KYC by making identity verification faster, more accurate, and scalable. Through technologies like OCR, machine learning, and biometrics, AI in KYC Automation streamlines onboarding while enhancing fraud detection. This transformation enables businesses to reduce costs and enhance customer experiences without compromising compliance.

However, balancing speed with security and fairness remains crucial. Companies must address risks like data privacy and algorithmic bias to build trust and ensure ethical outcomes. By combining advanced AI tools with transparent oversight, organizations can meet regulatory demands and protect customers effectively.

In essence, AI-powered kyc automation is not just a technological upgrade—it’s a strategic advantage that drives smarter, safer, and more inclusive identity verification for today’s digital world.

Frequently Asked Questions (FAQs)

Why is AI becoming essential for modern identity verification?

AI streamlines identity checks by automating data capture, verification, and risk assessment, thereby reducing onboarding time and human errors, and making verification faster and more reliable than traditional methods.

In what ways does AI help reduce operational costs in KYC processes?

AI reduces costs by automating repetitive tasks, minimizing manual reviews, and mitigating fraud losses, thereby lowering staffing needs and operational overhead and improving overall efficiency for businesses.

How can companies ensure fairness when using AI for KYC?

Ensuring fairness requires diverse training data, regular algorithm audits, and transparent decision-making. Addressing biases helps prevent discrimination and builds trust with customers.

Which industries are adopting AI-driven KYC beyond banking?

Besides finance, industries such as healthcare, insurance, and telecom are increasingly utilizing AI-powered KYC to streamline onboarding and combat fraud, responding to the growing identity risks across various sectors.

Table of Contents

- Introduction

- The Challenges of Manual KYC: Why It No Longer Works

- What Is AI in KYC Automation?

- How AI Is Used in KYC Automation?

- Technologies Powering AI KYC

- Benefits of AI in KYC

- Risks and Considerations

- The Future of AI KYC

- More Advanced AI Tools

- Tighter Regulations

- Conclusion

- Frequently Asked Questions (FAQs)