- Introduction

- The Basics of KYC

- What is Automated KYC?

- Why Businesses Use Automated KYC

- How Automated KYC Works

- Key Features of Automated KYC Verification

- Benefits for Businesses using Automated kYC Verification Processes

- Risks and Challenges of the Automated KYC Verification Process

- Use Cases Across Industries using Automated kyc verification process

- Future of Automated KYC Verification Process

- Case Study: FinTech Startup Streamlines Onboarding

- Why Automated KYC Verification is the Future of Secure Onboarding

- Frequently Asked Questions (FAQs)

Table of Contents

What is an Automated KYC Verification Process?

Introduction

Know Your Customer (KYC) is a process whereby businesses verify the identity of users to prevent fraud and comply with regulations. Originally, KYC was done manually at branches or via paperwork.

Automated KYC verification uses digital technologies (like OCR, AI, and biometrics) to replace face-to-face checks. This shift lets companies verify identities online in minutes instead of days. Automation reduces costs dramatically.

Platforms often offer an api for automated KYC verification so businesses can seamlessly plug identity checks into their apps.

According to an industry report, worldwide mobile banking users are projected to surpass 1.75 billion by 2024. (Source: ScoopMarket)

Automated KYC verification boosts efficiency and user experience while ensuring compliance with stringent KYC/AML rules.

The Basics of KYC

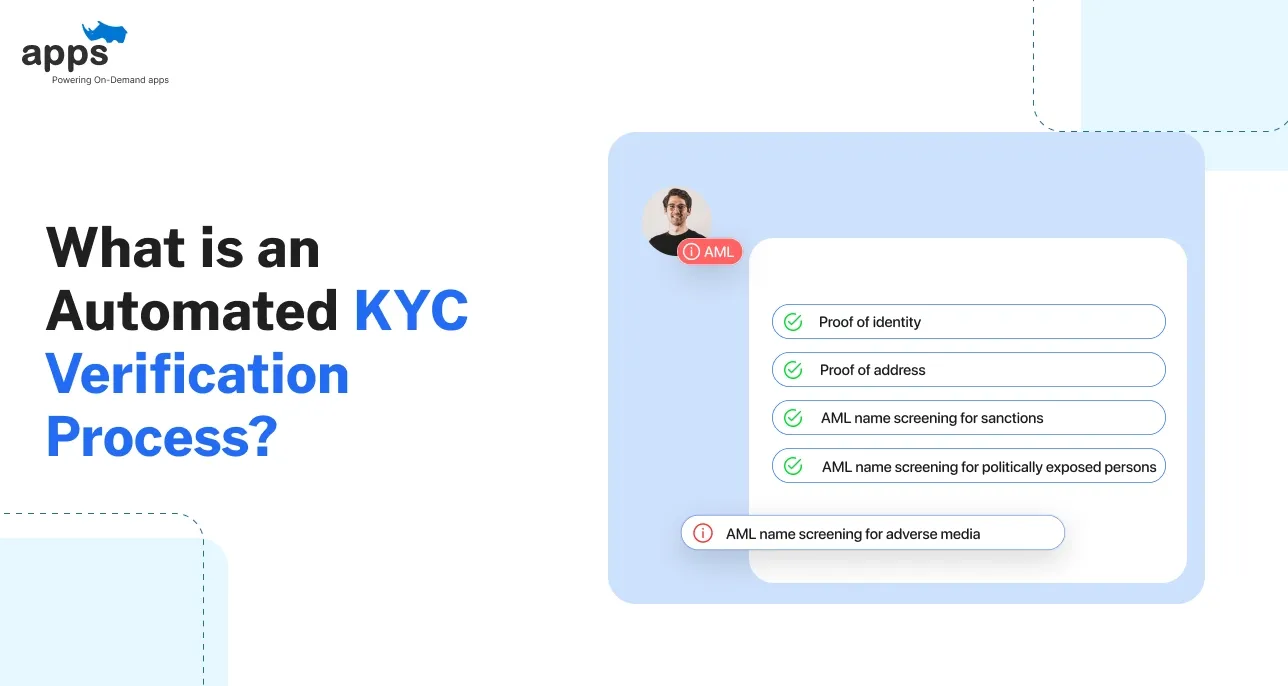

‘KYC’ stands for “Know Your Customer.” It is a mandatory identification and due diligence process used across industries to prevent fraud, money laundering, and financial crimes.

Banks, fintech firms, cryptocurrency exchanges, insurance companies, and healthcare providers must verify each customer’s identity under KYC rules. KYC is usually integrated with AML (Anti-Money Laundering) screening; together, they form a key part of regulatory compliance frameworks.

The goal is to confirm each customer truly is who they claim to be, maintaining trust and security.

Core steps include collecting personal details and verifying official documents.

- Customers upload a government-issued ID (passport, driver’s license, or national ID) and proof of address (such as a utility bill).

- Biometric checks (e.g., selfies or face scans) often match the person to their ID.

- KYC also involves screening customers against sanctions lists or Politically Exposed Person (PEP) lists to ensure AML compliance.

Together, these components create a robust identity verification and risk assessment before an account or service is approved.

What is Automated KYC?

Automated KYC verification refers to identity checks done with software and AI instead of humans. In this approach, an applicant’s ID documents and selfie photo are processed by algorithms to confirm identity.

Technology like OCR reads text from ID cards, and facial recognition compares the selfie to the photo on the ID. KYC tools also detect liveness (asking users to blink or nod) to prevent spoofing.

Many vendors provide an api for automated KYC verification that businesses can call from their apps. This lets companies send user data to the KYC service and get instant results. APIs often connect to government ID databases (like India’s Aadhaar or Emirates ID) for eKYC checks.

Traditionally, KYC was done by hand with paperwork and branch visits. As KYC processes become automated, verification becomes faster and more accurate. Manual KYC often took days, while automated KYC can verify a user in seconds.

It also logs every action with a timestamp for audit and compliance. Automated KYC streamlines onboarding by automating steps like ID capture, data extraction, and database screening.

Why Businesses Use Automated KYC

Businesses choose automated KYC verification for several reasons: faster processing, higher accuracy, reduced manual errors, and regulatory compliance.

It enables seamless, scalable onboarding with real-time checks, enhancing security and customer experience while significantly cutting operational costs.

- Speed and Efficiency: Automated systems complete checks in seconds, not days. This drastically shortens onboarding time and lowers customer drop-off. For example, many online banks let customers open accounts in minutes.

- Scalability: Automated solutions can handle thousands of verifications simultaneously without more staff. They operate 24/7 and scale on demand via the cloud, which is critical for fast-growing companies.

- Accuracy and Compliance: Automated checks use AI to reduce manual errors and flag risky cases. Every check is logged and consistent, helping firms meet strict KYC/AML regulations.

- Fraud Prevention: Advanced algorithms detect tampered documents or fake identities. Robust fraud engines catch anomalies early (around 6.5% of new accounts trigger alerts). Automation strengthens defenses against money laundering and identity theft.

- Better User Experience: Customers verify their ID on their device quickly and conveniently. Fast, user-friendly onboarding reduces abandonment and improves satisfaction.

- Continuous Operation: Automated KYC systems run continuously, even during holidays or high-demand periods. This ensures round-the-clock service, avoiding delays when human teams are unavailable. It also supports global operations across time zones.

These benefits make automated KYC verification indispensable for modern businesses.

How Automated KYC Works

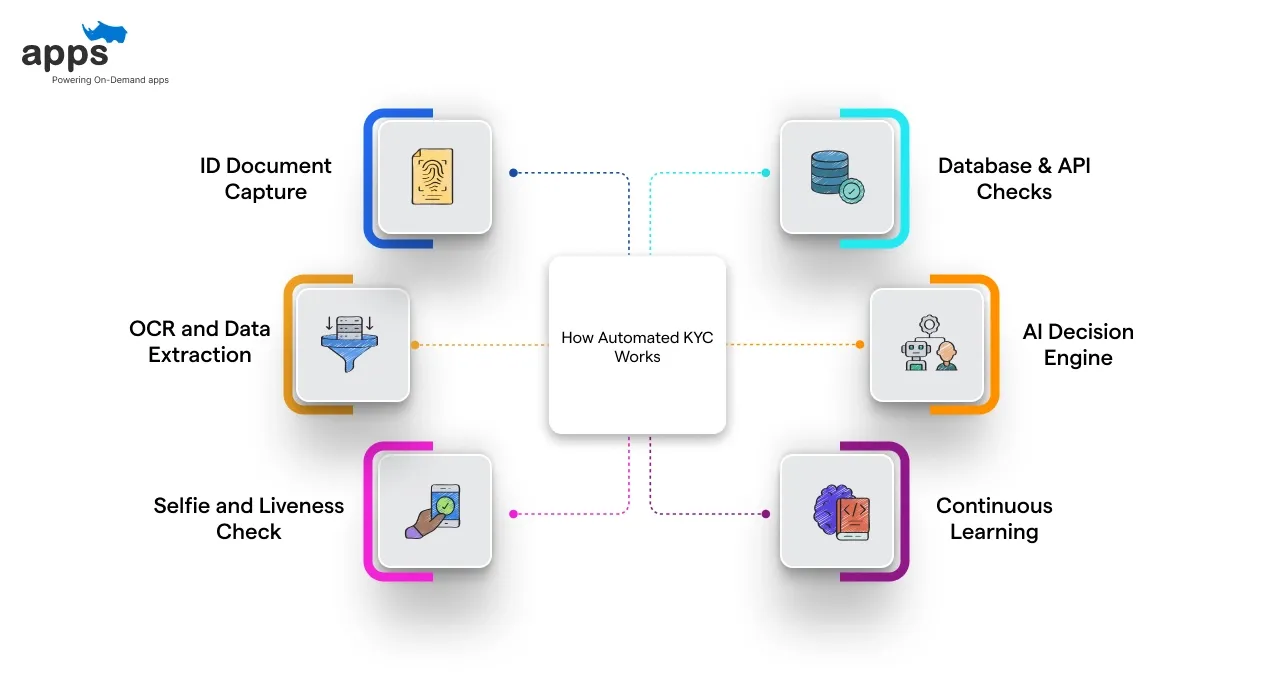

An automated KYC verification process typically follows these steps: the customer submits ID documents, the system extracts data using OCR, performs biometric checks, validates against global databases via APIs, and delivers an instant decision—pass, fail, or manual review.

- ID Document Capture: The user takes a photo of their ID (passport, driver’s license, or national ID) using a smartphone app or webcam.

On-screen guides help users align the document and capture a clear image.

- OCR and Data Extraction: Optical character recognition software reads text from the uploaded ID and converts it into digital data.

It extracts fields like name, date of birth, ID number, and address quickly and accurately. Modern systems support many document types, languages, and government-issued ID formats.

- Selfie and Liveness Check: The user then takes a live selfie. The system uses liveness detection to ensure a real person is present, not a photo or video.

Finally, it compares the selfie to the ID photo using facial recognition to verify the user’s identity.

- Database & API Checks: The extracted data is checked against external sources via APIs. An api for automated KYC verification might query national ID databases or global watchlists to confirm authenticity.

- AI Decision Engine: The software applies business rules and AI to assess risk. It uses all collected data to compute a risk score. If everything matches and the score is low, the identity is approved instantly.

- Continuous Learning: Machine learning models learn from each verification outcome. The system uses feedback from confirmed fraud cases or manual reviews to improve future decisions.

This feedback loop helps the KYC process get more accurate and adapt to new fraud tactics.

This step-by-step automation replaces the manual toil of data entry and checks, enabling real-time identity verification.

Key Features of Automated KYC Verification

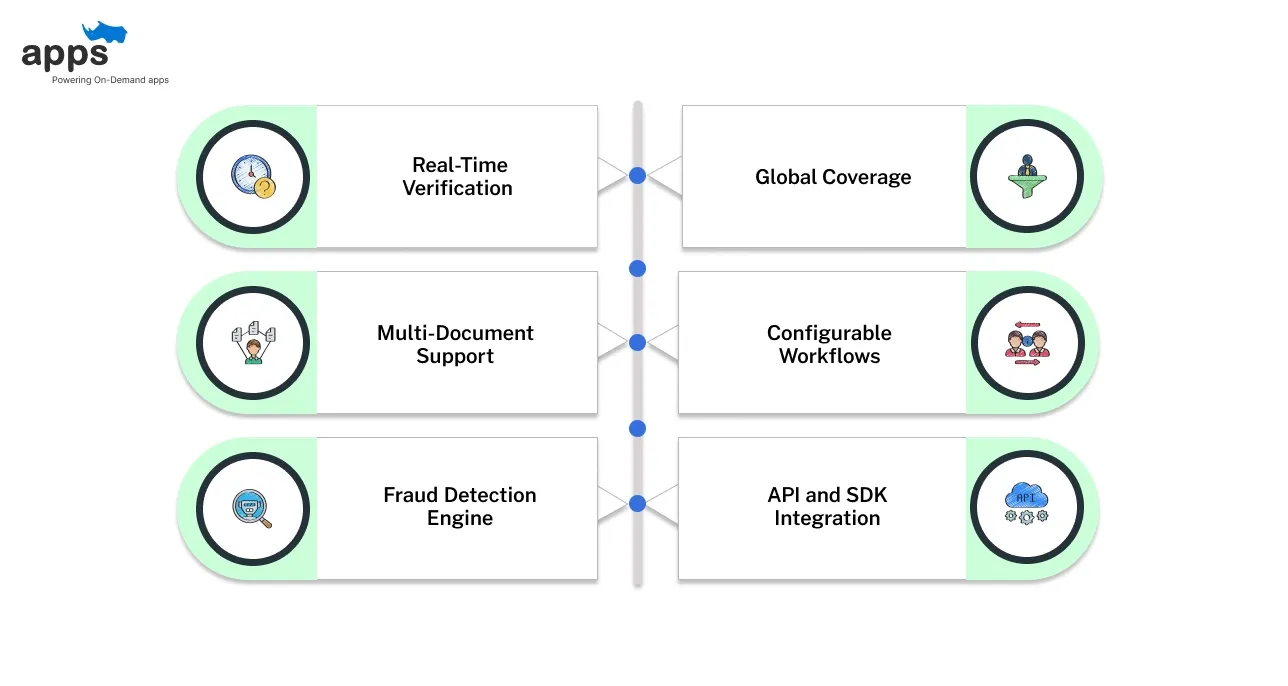

Key features of a modern automated KYC verification solution include advanced technologies that streamline identity checks, improve accuracy, and enhance compliance.

These tools ensure fast, secure, and scalable onboarding while supporting real-time processing and seamless integration through powerful verification APIs.

Real-Time Verification

- Instantly validates IDs and biometrics as soon as they are submitted, giving users immediate approval or rejection.

- No back-and-forth or long waits are needed, boosting conversion rates and operational efficiency.

Multi-Document Support

- Can verify various identity documents (passports, driver’s licenses, national IDs) and proof-of-address documents (utility bills, bank statements).

- The system handles multiple formats, issuers, and languages across the globe.

Fraud Detection Engine

- Built-in artificial intelligence analyzes IDs and selfies for signs of tampering or forgery (expired documents, photo swaps, deepfakes).

- It also checks device metadata and geolocation to catch suspicious cases.

Global Coverage

- Supports identities from dozens of countries and regulatory regimes.

- The system maintains a comprehensive library of ID templates and compliance rules, enabling compliant onboarding of customers worldwide.

Configurable Workflows

- Offers customizable verification flows and risk scoring.

- Businesses can set different checks or thresholds by customer type or region, giving flexibility to meet varying KYC regulations and use cases.

API and SDK Integration

- Provides a developer-friendly API for automated KYC verification and SDKs for mobile and web apps.

- With minimal coding, businesses can embed standard webhooks and JSON output to integrate identity checks into their applications directly.

These features enable a seamless, secure, and extensible identity verification process.

Benefits for Businesses using Automated kYC Verification Processes

Automated KYC verification offers multiple advantages, from reducing operational costs to accelerating onboarding. It enhances compliance, minimizes human error, and improves customer satisfaction.

With real-time processing and seamless API integration, businesses can scale efficiently while maintaining strong identity verification standards.

- Cost Savings: Eliminates large manual verification teams and paperwork. Automating KYC can cut onboarding costs by ~90%, saving millions annually. This makes verification almost cost-free, allowing budgets to focus on growth.

- Faster Onboarding: Identity checks that once took days now finish in seconds. This quick, frictionless verification means far fewer customers abandon the signup. Many businesses see a 30–40% higher completion rate with digital KYC.

- Better Compliance: Automation ensures consistent application of KYC/AML rules. Every step is logged electronically, generating detailed audit trails. This simplifies compliance and reporting to regulators, reducing legal risk.

- Fewer Errors: Automated data capture removes human mistakes. Advanced OCR and AI extract over 99% accurate data, and suspicious cases are flagged instantly. This dramatically reduces fraud losses, false declines, and rework.

- Improved User Experience: Customers verify their ID on their device, eliminating paperwork and long waits. The result is a faster, more convenient onboarding process that builds trust and boosts satisfaction.

- Scalability and Productivity: Automated KYC systems handle growth easily, processing thousands of verifications in parallel. It boosts throughput and frees up staff for higher-value tasks like customer support.

- Competitive Advantage: Early adopters of automated KYC stand out. Fast digital onboarding attracts tech-savvy customers, and firms can adapt quickly to new markets or regulations, staying ahead of competitors.

In summary, automated KYC verification helps businesses save time and money while improving accuracy and customer satisfaction.

Risks and Challenges of the Automated KYC Verification Process

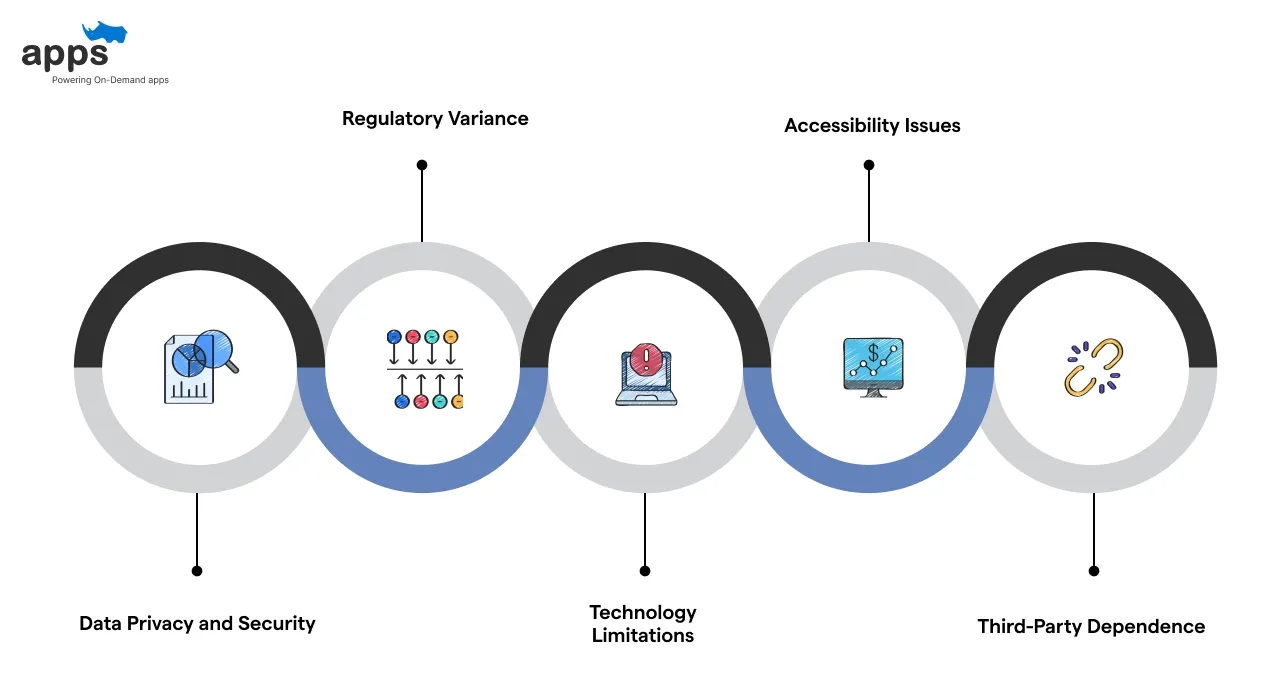

Despite its advantages, automated KYC verification has some challenges:

- Data Privacy and Security: Automated KYC processes handle sensitive personal data. Firms must ensure strong encryption and GDPR compliance. A breach or misuse of this data can cause legal penalties and loss of customer trust.

- Regulatory Variance: KYC rules differ by country or region. Not all regulators accept the same automated methods (for example, some require video or in-person checks). Keeping systems compliant everywhere is complex and requires frequent updates.

- Technology Limitations: Poor image quality, bad lighting, or hardware glitches can block verification. Facial recognition may perform unevenly across demographics unless trained well. Automated systems also need fallbacks when AI fails to recognize a user.

- Accessibility Issues: Not everyone has a smartphone, stable internet, or digital literacy. Elderly or disabled customers may find automated flows difficult. Companies often need assisted or offline alternatives to include these users.

- Third-Party Dependence: Using an API for automated KYC shifts control to the vendor. If the service goes down, onboarding halts. Vendor changes or outages require contingency planning. Relying on external databases also raises questions about data sovereignty.

Businesses must weigh these risks by selecting trusted providers and implementing robust privacy safeguards.

Use Cases Across Industries using Automated kyc verification process

Automated KYC verification is helpful in many sectors where identity verification and compliance are critical.

It helps businesses onboard users securely, reduce fraud, and meet regulatory demands across industries like banking, crypto, insurance, healthcare, and the gig economy.

Banking and Finance

- Banks and fintech companies use automated KYC to onboard new accounts, approve loans, and open payment or investment accounts.

- Many neobanks allow instant account opening online, combining KYC and AML checks in one workflow.

- This speeds up digital banking and meets regulations in real time.

Cryptocurrency and Trading

- Crypto exchanges and trading platforms require KYC to comply with AML laws.

- They use automated identity checks to verify users, prevent money laundering, and monitor transactions.

- Robust KYC is critical in this high-risk, regulated space.

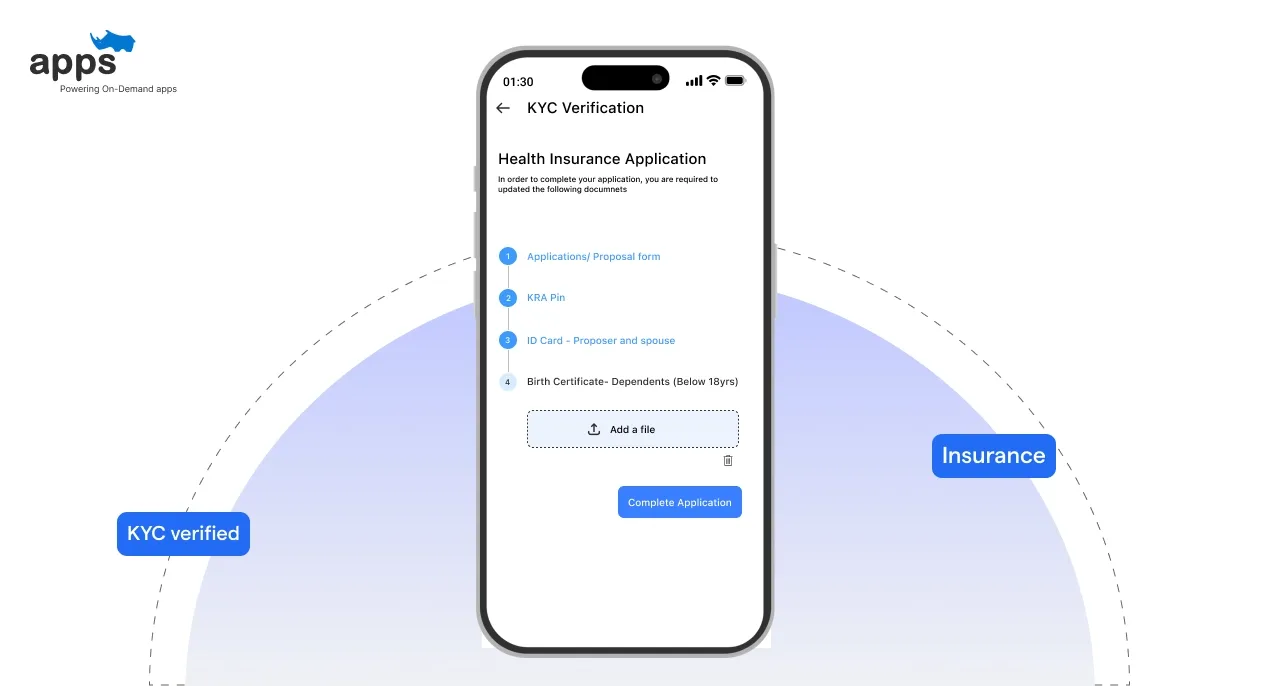

Insurance

- Insurance providers use automated KYC to verify policyholders’ identities

- It mainly prevents fraud during claims processing.

- It ensures policies are issued to real people and speeds up onboarding for new policies or claims.

Gig Economy and Transportation

- Ride-sharing and delivery services verify drivers and couriers before they start work.

- Automated KYC (checking driver's licenses and background) increases safety and trust.

- For example, it helps stop identity fraud by validating driver IDs in real time.

Healthcare

- Telemedicine platforms and hospitals can use identity verification during patient registration or telehealth sessions.

- Automated KYC helps healthcare providers confirm patient insurance details

- It protects against medical identity theft and improves patient safety and compliance.

Any industry that must trust customer identities (from opening bank accounts to selling insurance or crypto) can benefit from automated KYC.

Future of Automated KYC Verification Process

Industry experts see several upcoming trends shaping the future of automated KYC verification.

Innovations like eKYC, video-based identification, digital ID wallets, and blockchain-based identity systems are making verification faster, more secure, and globally interoperable across industries and borders.

eKYC and Digital IDs

- More countries are rolling out electronic ID systems.

- Governments enable instant verification, reducing paperwork.

- Banks can tap into these e-government databases for near-instant onboarding.

Video KYC

- Live video calls with agents or AI guidance are becoming common, especially where regulations allow it.

- For example, banks in India and Singapore support Video KYC.

- This adds human oversight to remote onboarding.

Global Digital Identity

- International digital passports or identity wallets could let users reuse a verified identity across borders.

- Initiatives like blockchain-based self-sovereign IDs (SSI) are emerging.

- Users control and share verified credentials without centralized storage.

Advanced Biometrics and AI

- KYC will leverage more biometric modalities (iris scanning, voice recognition) and AI-driven fraud detection.

- Continuous, passive verification monitoring of login behavior or geolocation patterns) may also evolve

- Keeping identity checks active beyond initial onboarding.

Overall, the future is ever more seamless, secure, and user-friendly KYC using emerging tech.

Case Study: FinTech Startup Streamlines Onboarding

- Problem: FinGrow, an online lending startup, faced high abandonment during customer onboarding. Manual KYC took up to 2–3 days per applicant, resulting in 20% of users dropping off.

Staff were overloaded with verification paperwork, and the company struggled to scale. Regulatory audits also risked penalties due to inconsistent checks.

- Solution: FinGrow integrated an automated KYC verification API from AppsRhino into its mobile app. Applicants simply snapped their ID and a selfie. The system ran OCR, liveness, and watchlist checks instantly.

This fully automated workflow replaced 90% of manual effort. FinGrow also retained detailed audit logs for compliance.

- Results: Onboarding time plunged from days to minutes, and completion rates jumped by over 35%. The automated system caught fraudulent IDs early, reducing bad loans.

Verification costs per customer fell by nearly 95% (from roughly $10 down to cents). FinGrow’s compliance team reported faster audits and greater confidence in KYC procedures. FinGrow scaled rapidly without adding headcount, thanks to automated KYC verification.

Why Automated KYC Verification is the Future of Secure Onboarding

Automated KYC verification transforms identity checks from a costly, manual process into a smooth, scalable workflow.

Using AI-driven APIs and automated workflows, businesses onboard customers much faster, reduce errors, and stay compliant with KYC/AML regulations. Companies of all sizes benefit from real-time ID verification and biometric authentication, improving conversion rates and customer trust.

With automated KYC, firms save significant time and money (up to 90% lower costs) while delivering a frictionless user experience.

We encourage businesses to adopt these solutions to stay competitive and meet evolving compliance demands.

AppsRhino offers custom development services for digital onboarding solutions, including identity verification and KYC API integration, which help companies seamlessly embed identity checks into their apps and web portals.

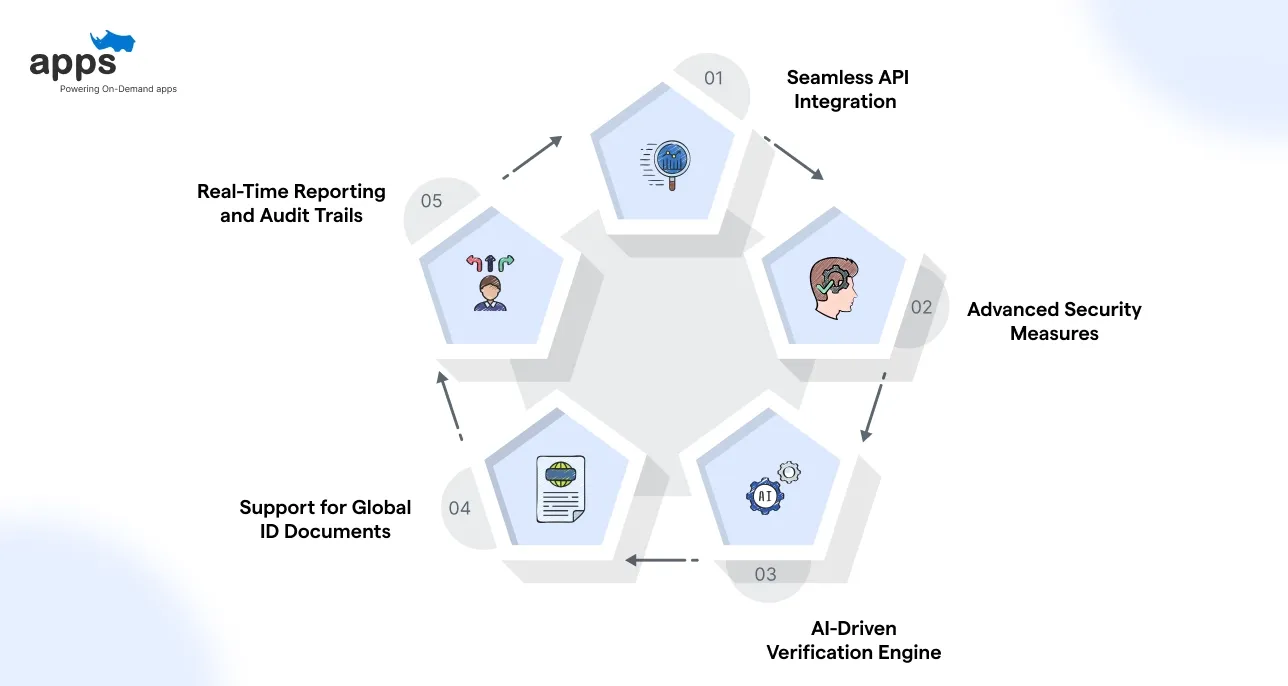

Why Choose AppsRhino for Automated KYC Verification?

- Seamless API Integration – Easily integrate the API for automated KYC verification into your existing platforms and workflows.

- Advanced Security Measures – End-to-end encryption and full compliance with global data protection laws like GDPR and CCPA.

- AI-Driven Verification Engine – Utilizes OCR, biometrics, and facial recognition for high-accuracy and real-time checks.

- Support for Global ID Documents – Verifies government-issued IDs from over 190 countries, with multilingual processing.

- Real-Time Reporting and Audit Trails – Access comprehensive dashboards for tracking, compliance, and performance analytics.

AppsRhino helps businesses simplify onboarding, reduce fraud, and maintain regulatory compliance—all in a single platform.

Frequently Asked Questions (FAQs)

How secure is an API for automated KYC verification during data transfer?

APIs for automated KYC verification use bank-level encryption protocols (like TLS 1.2+) and tokenization to ensure that personal data remains secure during system transfer.

Can automated KYC verification handle high volumes of simultaneous onboarding requests?

Yes, automated KYC systems are cloud-based and scalable, capable of handling thousands of verifications per minute without performance drops—ideal for fintechs, exchanges, and high-growth startups.

How customizable is the API for automated KYC verification for different jurisdictions?

Leading APIs for automated KYC verification allow region-specific configurations, supporting local document types, language preferences, and jurisdiction-based compliance flows like GDPR or eIDAS.

What happens if automated KYC verification fails due to poor image quality?

If image capture fails due to poor lighting or blur, most systems prompt users to retake images and can offer fallback options like manual verification or video KYC.

Can an API for automated KYC verification be used in mobile apps?

Yes, most automated KYC APIs provide mobile SDKs for iOS and Android, enabling in-app ID capture, biometric verification, and seamless onboarding experiences for mobile-first users.

What is the average implementation time for integrating an automated KYC API?

Implementation time can vary by provider, but most plug-and-play KYC APIs can be integrated in under a week with pre-built SDKs, sample code, and developer documentation.

Table of Contents

- Introduction

- The Basics of KYC

- What is Automated KYC?

- Why Businesses Use Automated KYC

- How Automated KYC Works

- Key Features of Automated KYC Verification

- Benefits for Businesses using Automated kYC Verification Processes

- Risks and Challenges of the Automated KYC Verification Process

- Use Cases Across Industries using Automated kyc verification process

- Future of Automated KYC Verification Process

- Case Study: FinTech Startup Streamlines Onboarding

- Why Automated KYC Verification is the Future of Secure Onboarding

- Frequently Asked Questions (FAQs)