- What Is an Insurance Software Platform?

- Types of Insurance Software

- What are the top insurance software features you should know?

- What are the benefits of a digital insurance software platform?

- How to Choose the Right Insurance Software System?

- AppsRhino Insurance Software: What Makes It Different?

- Conclusion

- Frequently Asked Questions (FAQs)

Table of Contents

16 Top Features of a Modern Digital Insurance Platform

People buy insurance hoping they’ll need it. And when they do, they expect everything to work fast, like claims, updates, approvals, and support. The problem is that most insurers still rely on old tools that slow everything down.

Think about the last time you filed a claim or updated a policy. Long forms. Delays. Repeated information. That frustration is precisely what modern Insurance Software Features are designed to eliminate.

Today’s insurance software systems automate tasks, connect teams, and deliver the smooth digital experience customers already expect from banks, e-commerce apps, and fintech platforms.

In this blog, you’ll understand what a digital insurance platform really is, the 16 top Insurance software features and benefits that matter most, and how these systems help insurers finally deliver speed, transparency, and trust at scale.

What Is an Insurance Software Platform?

Insurance today moves fast; policies, claims, risk checks, compliance updates, and customer support all happen at once.

An insurance software platform is the system that keeps everything running smoothly behind the scenes. It connects teams, automates routine work, stores policy and claim data, and helps insurers deliver faster, more accurate service.

Instead of juggling spreadsheets, emails, and manual approvals, insurers use modern Insurance software systems to manage every step of the customer and policy lifecycle in one place. This is why these platforms have become essential in digital insurance transformation.

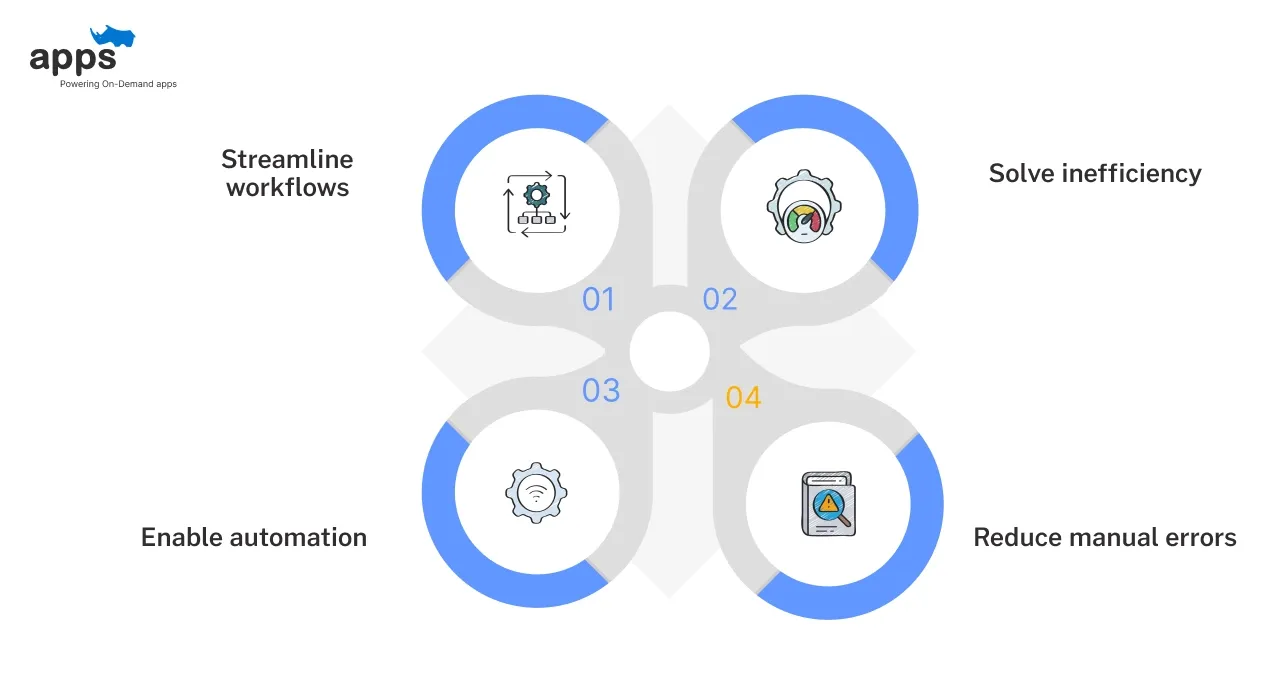

Core Purpose of Insurance Software Systems

The primary job of an insurance platform is to simplify complex workflows. It replaces slow, manual processes with smart insurance automation, helping insurers operate more efficiently.

- Streamline workflows: Automates repetitive processes like premium calculation, policy updates, and claim routing.

- Solve inefficiency: Centralize data so teams don’t switch tools or repeat work.

- Enable automation: Tools like underwriting automation and risk assessment tools reduce approval time and improve accuracy.

- Reduce manual errors: With built-in validation and standardized steps, costly mistakes drop significantly.

A strong platform ensures the insurer can handle higher volumes without compromising quality.

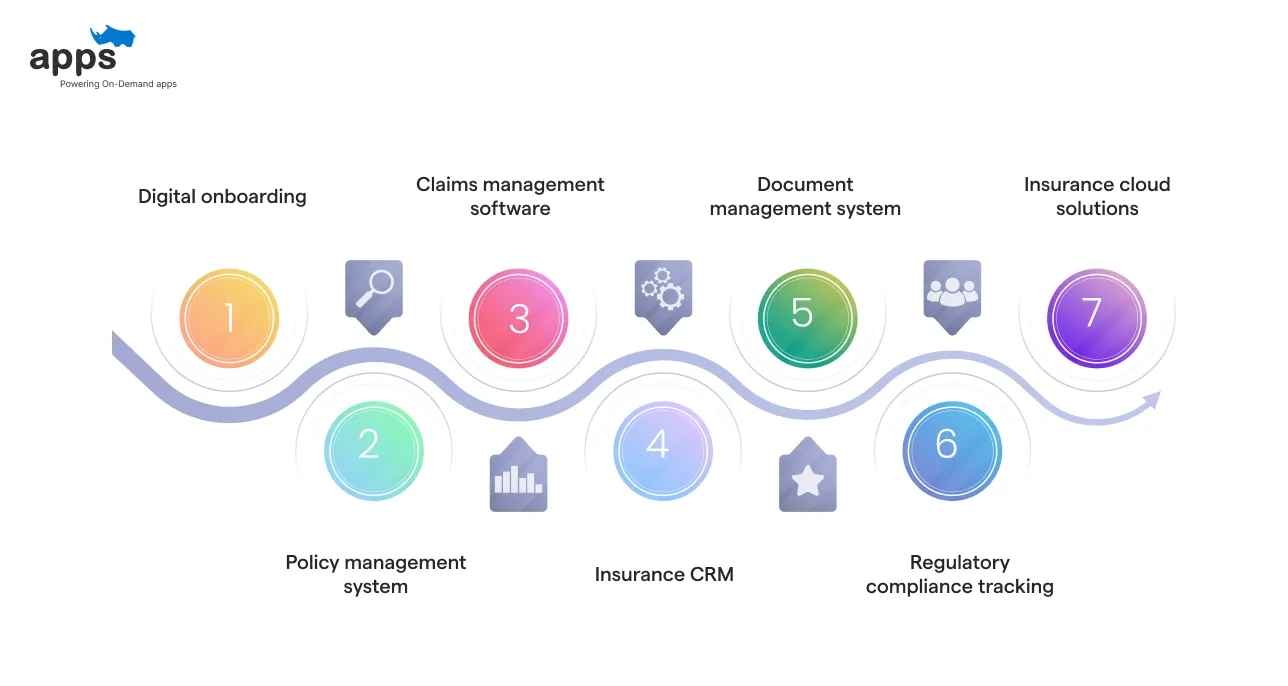

How Insurance Software Supports Modern Operations

Modern insurance operations involve multiple touchpoints. A digital platform keeps everything connected through unified insurance workflows:

- Digital onboarding: Collects documents, KYC details, and customer information without manual paperwork.

- Policy management system: Manages issuance, renewals, endorsements, cancellations, and premium updates from one dashboard.

- Claims management software: Speeds up claim reporting, assessments, fraud checks, and settlement.

- Insurance CRM: Helps teams manage leads, agents, customer history, and interactions.

- Document management system: Stores forms, reports, and policy files securely.

- Regulatory compliance tracking: Automates HIPAA, GDPR, and NAIC compliance steps, reducing risk.

- Insurance cloud solutions: Allow secure remote access, scalability, and seamless integrations.

Each module works together to deliver faster service and a better customer experience, something which traditional tools simply cannot match.

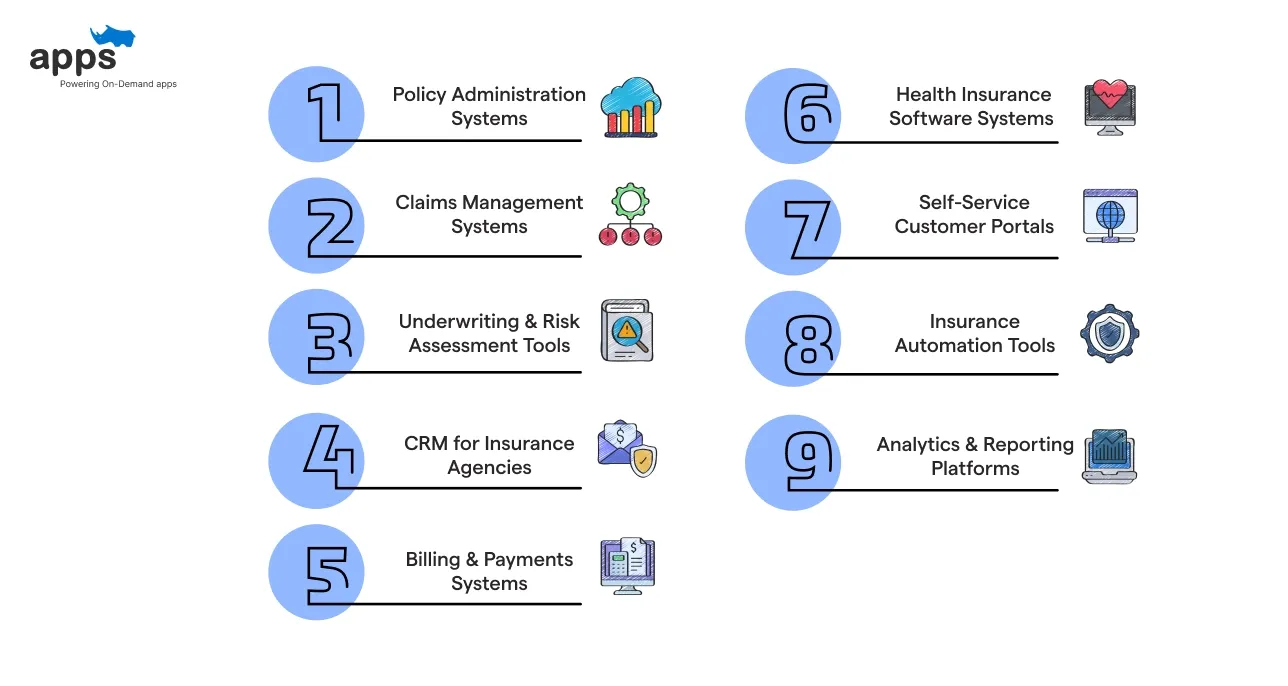

Types of Insurance Software

Modern insurers rely on multiple digital tools, but not just one platform, to manage policies, customers, claims, billing, and risk. Different insurance lines need different capabilities, which is why insurers use a mix of insurance software systems to automate operations, reduce manual work, and improve decision-making.

Below are the core platforms used across the industry.

1. Policy Administration Systems (PAS)

A PAS handles the entire policy lifecycle, including creation, endorsements, renewals, and cancellations. This is crucial as effective automated insurance policy renewals prevent lapses and ensure revenue continuity.

It ensures consistency, reduces manual steps, and strengthens compliance across the policy management system.

2. Claims Management Systems

This software automates FNOL, documentation, assessments, approvals, and settlements. For insurers focused on reducing friction and improving payout speed, understanding what automated claims processing is essential.

Modern claims management software also integrates fraud scoring to detect anomalies early through a robust fraud detection system.

3. Underwriting & Risk Assessment Tools

These platforms support rule-based underwriting, AI-driven scoring, and risk profiling. With underwriting automation and AI in insurance, insurers improve pricing accuracy and shorten decision time.

4. CRM for Insurance Agencies

An insurance CRM centralizes leads, customer interactions, renewal alerts, and agent workflows. It helps teams manage sales pipelines and improve retention through targeted engagement.

5. Billing & Payments Systems

This software automates premium invoices, reminders, reconciliation, and recurring auto-pay.

A strong billing and payments module reduces lapses and streamlines customer payment experiences.

6. Health Insurance Software Systems

These systems manage provider networks, pre-authorization, member portals, and claims adjudication. Advanced health insurance software features simplify complex healthcare workflows and ensure regulatory compliance.

7. Self-Service Customer Portals

These portals let policyholders manage policies, download documents, submit claims, and make payments without support. They improve digital onboarding, reduce support load, and enhance customer satisfaction across modern insurance software systems.

8. Insurance Automation Tools (RPA)

RPA automates repetitive workflows like data entry, claim verification, and policy updates. This level of insurance automation reduces manual errors, accelerates processes, and lowers insurers' operational costs.

9. Analytics & Reporting Platforms

These tools provide real-time dashboards for risk scoring, premium calculation, fraud alerts, and performance trends. Advanced insurance analytics helps teams make data-driven decisions across underwriting, claims, and customer management.

These software categories form the digital foundation of modern insurers, and together they create a seamless, automated, and scalable insurance ecosystem.

What are the top insurance software features you should know?

Modern insurance companies run on speed, accuracy, and customer experience. That’s why Insurance Software Features play such a crucial role in how insurers operate today. Whether you manage health plans, life policies, or commercial claims, digital tools now handle everything from onboarding to underwriting and compliance tracking.

This section breaks down the most essential capabilities inside today’s insurance software systems, helping you see what truly matters when choosing a platform.

1. Digital Onboarding & KYC Automation

Digital onboarding is one of the most essential insurance software features, especially as customers increasingly expect instant self-service. It replaces paperwork with automated identity verification, eKYC, OCR document scanning, and guided digital forms.

It helps insurers reduce onboarding delays, improve compliance, and offer a smoother customer experience.

Key advantages:

- Faster customer acquisition

- Fewer errors through automated data capture

- KYC and AML verification built into workflows

This feature is now standard across health, life, and general insurance software.

2. Policy Management System

A core module of most insurance software systems, a policy management system handles policy creation, updates, renewals, endorsements, and cancellations. It eliminates spreadsheet-based workflows and ensures every policy follows proper underwriting rules and compliance checks.

Key advantages:

- Automated policy lifecycle management

- Error-free updates and renewals

- Transparent record-keeping for audits

This is the backbone of any digital insurer.

3. Claims Management Software

Claims are where customer trust is built or lost. A strong claims management software feature automates FNOL (First Notice of Loss), validations, settlements, and document review.

It reduces claim cycle time with automated workflows, fraud flags, and customer notifications.

Key advantages:

- Faster claim approvals

- Improved transparency

- Lower claim leakage

Add-ons such as rule engines and fraud detection systems further enhance accuracy.

4. Underwriting Automation & Risk Assessment Tools

Underwriting determines risk, pricing, and profitability. Modern platforms use AI, ML models, and predictive analytics to automate underwriting decisions. These tools evaluate risk profiles in seconds, ensuring fair pricing and consistent decisions.

Key advantages:

- Rule-based underwriting

- Automated risk scoring

- AI/ML-based predictions

- Portfolio-level risk insights

Strong risk assessment tools help insurers serve customers faster and reduce underwriting errors.

5. Customer Relationship Management (Insurance CRM)

An insurance CRM centralizes customer data, interactions, lead journeys, and communication histories. It helps agents and teams track every conversation, follow-up, and policy touchpoint.

Key advantages:

- Improved cross-sell and upsell

- Personalized communication

- Better customer retention

CRM integrations with WhatsApp, email, SMS, and agent portals make service easier.

6. Billing & Payments Module

Insurance billing is complex, especially with recurring premiums, installments, and multiple payment modes. A strong billing and payments module automates invoicing, reminders, reconciliation, and payment tracking.

Key advantages:

- Automated premium calculation

- Recurring billing

- Payment failure alerts

- Refund and adjustment handling

This feature reduces accounting errors and improves financial accuracy.

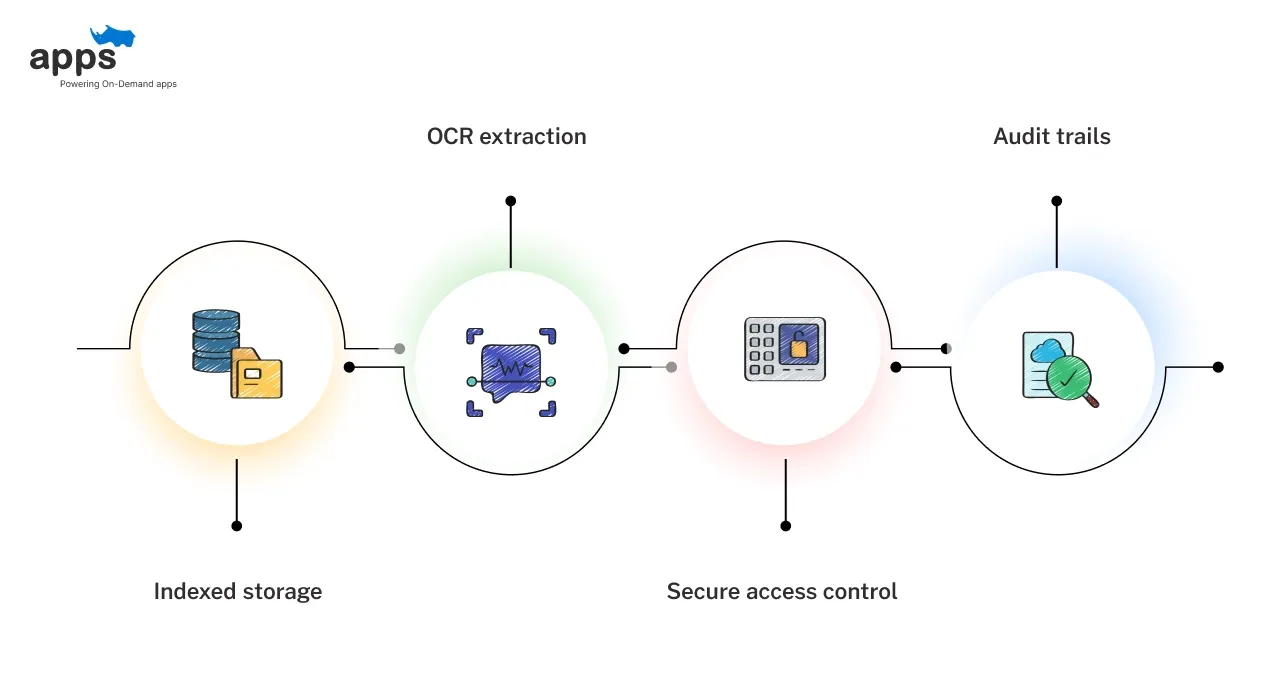

7. Document Management System (DMS)

Insurers deal with countless documents: policies, claims, KYC records, medical bills, agreements, and more. A centralized document management system ensures everything is stored securely and easily accessible.

Key advantages:

- Indexed storage

- OCR extraction

- Secure access control

- Audit trails

This reduces time spent searching for files and ensures compliance.

8. Insurance Cloud Solutions

Cloud deployment helps insurers scale without the expense of on-premises infrastructure. Cloud-based insurance software systems offer high availability, flexible storage, and remote access.

Key advantages:

- Faster updates

- Lower IT costs

- Better disaster recovery

- Global accessibility

Cloud adoption is now a must for digital transformation.

9. Insurance Automation (RPA Integration)

Automation is one of the most transformative features of insurance software. RPA bots automate repetitive tasks such as form processing, data entry, validation, and notifications.

Key advantages:

- Speed

- Operational accuracy

- Workforce productivity

It also reduces manual workload for teams.

10. Fraud Detection System

Fraud remains a significant challenge across claims, underwriting, and billing. AI-based fraud detection flags suspicious patterns, duplicate claims, mismatched documents, and unusual customer behavior.

Key advantages:

- Lower financial loss

- Improved trust

- Stronger decision-making

This is essential for insurers handling large claim volumes.

11. Regulatory Compliance Tracking

Insurance companies must follow strict rules, including HIPAA, GDPR, NAIC, IRDAI, and other global/local regulations. Compliance engines track policy requirements, consent, data privacy rules, and audit logs.

Key advantages:

- Automated reminders

- Policy rule validation

- Audit-friendly reports

This prevents violations and protects insurers from penalties.

12. Insurance APIs & Third-Party Integrations

Modern platforms depend on robust insurance APIs to connect to external systems such as hospitals, payment gateways, banks, KYC providers, telematics tools, and agent portals.

Key advantages:

- Faster workflows

- Real-time data exchange

- Better scalability

APIs keep the insurance ecosystem connected and efficient.

13. Analytics & Reporting Tools

Insurers need accurate insights for pricing, risk scoring, churn prediction, and claim forecasting. Advanced insurance analytics turn raw data into actionable insights.

Key advantages:

- Loss ratio analysis

- Customer segmentation

- Premium and revenue dashboards

- Predictive risk modeling

This improves decision-making at every level.

14. Self-Service Customer Portals

Self-service is now mandatory. Customer portals help users manage their policies independently.

Key advantages:

- Download documents

- File claims

- Make payments

- Update information

This improves satisfaction and reduces support load.

15. Insurance Chatbots & Virtual Assistants

AI chatbots help customers check policy status, ask questions, submit claims, and get quotes instantly.

Key advantages:

- Support costs

- Response time

- Agent workload

They ensure smarter, faster customer service.

16. Insurance Agent Portal

Agent portals provide field agents and partners with a unified platform for sales, document upload, lead management, and commission tracking.

Key advantages:

- More transparency

- Faster sales cycles

- Better productivity

A must-have for agencies.

These core Insurance Software Features define the strength and efficiency of any modern digital insurance platform.

Now let’s explore how these features translate into real-world business benefits.

What are the benefits of a digital insurance software platform?

Moving to a digital insurance platform does more than just replace paper; it transforms the way insurers work by making every step smarter, faster, and more customer-friendly.

Here are the top benefits of a well-built platform: it can cut costs, accelerate underwriting and claims, improve compliance, and create a seamless experience for both insurers and policyholders.

1. Fast, Automated Processing and Higher Efficiency

A significant perk of modern insurance software systems is automation. Tasks such as underwriting, claims processing, billing, and policy management are streamlined, eliminating manual data entry and redundant paperwork

For example, digital claims processing has been shown to reduce average settlement times by 50%, often enabling insurers to settle claims within hours rather than days. Furthermore, the use of virtual inspections and AI-powered systems can reduce travel time for claims adjusters by 40%, enabling greater efficiency.

This operational efficiency reduces human error, lowers labor costs, and frees up staff to focus on complex tasks, making policy administration and claims management far more reliable and scalable.

2. Better Risk Assessment and Underwriting Accuracy

Digital platforms often come with advanced underwriting automation, risk assessment tools, and analytics engines. These tools use historical data, customer profiles, and real-time inputs to price risks more accurately and tailor policies better.

By applying data analytics and AI, insurers get a clearer, data-driven view of risk and can make more informed decisions faster.

This shift toward AI-driven processes has been shown to deliver a 10% to 15% increase in premium growth and improved accuracy, making AI integration essential for competitive survival. Some organizations report that advanced cloud analytics platforms have improved risk assessment accuracy by 41.6%.

3. Seamless Integration and Unified Workflow Across Functions

Traditional insurance operations often suffer from data silos: underwriting, policy management, billing, and claims run on separate systems, leading to inefficiencies and errors. Digital insurance platforms integrate all these functions into a unified system.

This integration helps connect the policy management system, billing and payments module, fraud detection system, document management system, and even external insurance APIs seamlessly.

The ability of composable cloud architectures to connect modules means that 85% of customers can implement specific functionality without dependencies on broader system updates, dramatically improving operational flexibility and data flow.

4. Improved Customer Experience and Engagement

Customers today expect fast, transparent, digital-first insurance experiences from quotes and policy purchase to claims and renewals. Digital platforms enable self-service portals, chatbots, instant quotes, and real-time updates.

This improves trust and satisfaction. Digital-first claim experiences achieve significantly higher customer satisfaction, with scores reaching 871 points (on a 1,000-point scale), representing the largest differential recorded versus traditional channels.

Furthermore, 82% of customers prefer using mobile apps for policy management, demonstrating a significant shift toward digital self-service platforms.

5. Cost Savings and Lower Operational Overheads

Because many tasks are automated and workflows are streamlined, insurers save significantly on operational costs, says Planeks reports. Reduced manual labor, fewer data errors, and faster processing all contribute to lower overhead.

Cloud-based insurance software platforms often reduce infrastructure costs and maintenance overhead compared to legacy systems. Adoption of the cloud, for instance, can reduce IT investments by 30% to 40%. Moreover, modern policy administration systems have enabled insurers to cut operational costs by 40% to 60% within the first year of implementation.

6. Faster Time-to-Market for New Products

Digital platforms make it much easier to launch new insurance products or adjust existing ones. Because all modules are connected, insurers can roll out new plans, update pricing, or offer new coverage types with minimal friction.

The modernization of core platforms to a cloud-native architecture has been shown to reduce product development cycles from 12–18 months to just 3–6 months for most insurance carriers. This agility gives insurers a significant competitive edge in a fast-evolving industry.

7. Enhanced Data Analytics, Fraud Detection, and Compliance

Modern insurance software solutions often include analytics and risk-management tools that provide deeper insight into claims trends, customer behavior, and potential fraud. AI-powered systems and data-driven processes help identify suspicious patterns, improving fraud detection and claim accuracy.

Cloud-based solutions also offer better data governance, security, and compliance features essential for meeting regulatory standards and protecting customer privacy.

Digital insurance software platforms are more than a technological upgrade; they reshape how insurers operate, engage customers, manage risk, and innovate.

Next, we’ll dig into key Insurance Software Features that enable all these benefits, from underwriting automation to integrated billing and fraud-detection tools.

How to Choose the Right Insurance Software System?

With so many insurance software systems available, businesses need a platform that aligns with long-term goals and delivers the essential Insurance Software Features to stay competitive. Below are the key factors every insurer should evaluate before investing.

Evaluate Core Insurance Software Features

Start with the core capabilities. Your platform should include a policy management system, automated claims handling, underwriting support, and an integrated insurance CRM. These modules form the operational foundation.

Choose systems that also offer digital onboarding, fraud detection, premium calculation, and a document management system to avoid manual dependencies and workflow gaps.

Check Compliance Requirements

Insurance operations rely on strict regulatory frameworks. Your software must support HIPAA, GDPR, NAIC, audit logs, encryption, and controlled access. Platforms with built-in compliance automation reduce legal and operational risks.

Compliance should not be an afterthought; ensure the software embeds reporting, monitoring, and regulatory updates.

Review Integration Capabilities

Modern insurers rely on multiple tools, so integrations are essential. Look for systems that support insurance APIs, payment gateways, underwriting tools, third-party fraud systems, EHR integrations for health insurance software features, and agent portals.

Strong integrations reduce manual effort, improve accuracy, and ensure data flows smoothly across systems.

Prioritize Scalability & Cloud Architecture

Scalable, cloud-native systems adapt as your operations grow. Insurance cloud solutions offer better uptime, faster deployment, and stronger security.

Choose software that can handle increased policy volumes, new insurance lines, automation expansion, and distributed teams without performance issues or costly upgrades.

Assess User Experience & Training Needs

A user-friendly platform increases adoption and reduces training time. Look for intuitive dashboards, clear workflows, and easy navigation for both employees and customers.

When software is simple to use, teams spend less time troubleshooting and more time efficiently processing policies, claims, and customer requests.

Look for Customization & Flexibility

Every insurer has unique workflows. Choose software that allows flexible configuration of forms, rules, policy structures, billing cycles, and claims processes.

High flexibility ensures your system adapts to business needs without heavy custom development or lengthy implementation cycles.

Evaluate Security & Data Protection

Security is critical for insurance data. Select a platform with encryption, multi-factor authentication, secure document storage, access controls, and disaster recovery tools.

Strong protection prevents breaches and maintains trust with policyholders and regulators.

Once you know what to look for, the next question is: which platform actually offers these capabilities? That’s where AppsRhino stands out.

Let’s find out how?

AppsRhino Insurance Software: What Makes It Different?

Choosing the right insurance platform matters, but choosing the right technology partner matters even more. AppsRhino offers more than basic Insurance Software Features; it delivers a complete digital ecosystem built for insurers who want automation, accuracy, compliance, and scalability.

Our platform streamlines everyday insurance workflows, supports multiple insurance lines, and helps teams operate faster with fewer errors.

Here’s what sets AppsRhino apart in a crowded market.

1. AI-Driven Underwriting & Risk Assessment

AppsRhino uses advanced AI in insurance to analyze risk profiles, automate underwriting rules, and reduce decision time. Insurers get faster approvals with higher accuracy.

2. End-to-End Policy & Claims Management

Our integrated policy management system and claims management software help insurers process policies, FNOLs, settlements, and compliance checks from a single unified dashboard.

3. Full Compliance Automation

Built-in HIPAA, GDPR, and NAIC compliance tools ensure secure operations, audit readiness, and regulatory reporting without manual effort, reducing risk and increasing trust.

4. Seamless Insurance API & Third-Party Integrations

AppsRhino connects with CRMs, payment gateways, provider networks, fraud detection systems, and other insurance software systems, eliminating data silos and repetitive tasks.

5. Cloud-Native Architecture for Scale

With robust insurance cloud solutions, the platform supports high transaction volumes, remote teams, and multi-branch operations while maintaining performance and uptime.

6. Customizable Workflows for Every Insurance Line

From health to auto to life, the platform adapts to unique processes. Flexible rules, forms, billing cycles, and automated workflows enable insurers to tailor workflows effortlessly.

7. Advanced Analytics & Fraud Detection

AppsRhino provides real-time insurance analytics, premium forecasting, and fraud-detection alerts to help insurers reduce losses and make data-driven decisions.

With a platform that strong, all that’s left is exploring how it fits into your broader digital transformation plan.

Conclusion

Modern insurance isn’t struggling because of a lack of customers; it’s working because legacy systems slow teams down and limit growth. The right Insurance Software Features change that by giving insurers automation, clarity, compliance, and real-time control over every policy and claim. When your tools work smarter, both your team and your customers feel the difference.

This is precisely where AppsRhino helps insurers move ahead.

We build custom insurance software systems, end-to-end policy and claims platforms, health insurance software, intelligent automation workflows, and fully tailored digital experiences for agencies, brokers, and carriers.

Whether you need AI-driven underwriting, seamless CRM integrations, member mobile apps, or scalable cloud architectures, AppsRhino delivers solutions engineered for speed, compliance, and long-term growth.

If you’re ready to upgrade operations with modern tech that actually fits your business, AppsRhino builds it for you.

Frequently Asked Questions (FAQs)

What are the features of insurance agency management software?

Insurance agency management software typically includes lead tracking, policy lifecycle management, renewals automation, document storage, task workflows, and reporting dashboards to help agencies operate more efficiently and reduce manual work.

What software is used in insurance?

Insurers use a mix of policy administration systems, claims management software, underwriting tools, CRMs, health insurance platforms, billing systems, analytics dashboards, and cloud-based digital onboarding solutions, depending on their business line.

What are the features of property & casualty insurance management software?

P&C systems include risk assessment tools, claims automation, catastrophe modeling, policy rating engines, fraud detection, multi-line policy creation, and regulatory compliance support for fast, accurate quote-to-claim workflows.

What are the 5 P's of insurance?

The 5 P’s of insurance are Product, Pricing, Placement, Promotion, and People, and they help insurers structure plans, position offerings, and deliver customer experiences across digital and offline touchpoints.

How long does it take to implement a complete insurance software system?

Implementation timelines vary from 3 to 9 months depending on customization, integrations, data migration needs, and internal readiness. Cloud-based platforms usually deploy faster than legacy on-premise systems.

Do small insurance agencies also benefit from digital insurance software?

Yes, smaller agencies often see the most significant impact. Automation cuts manual effort, digital onboarding accelerates sales, and integrated CRMs help teams manage more customers without increasing staff.

Table of Contents

- What Is an Insurance Software Platform?

- Types of Insurance Software

- What are the top insurance software features you should know?

- What are the benefits of a digital insurance software platform?

- How to Choose the Right Insurance Software System?

- AppsRhino Insurance Software: What Makes It Different?

- Conclusion

- Frequently Asked Questions (FAQs)